My previous post, The Hidden Costs of Cost-Plus Pricing explains that while cost-plus pricing certainly has its place, there are also several downsides to the approach. Modern pricing strategy should balance at least three different C-factors: cost, customer value and competitive situation and cost-plus pricing doesn’t allow for any of those considerations.

So your next question then might be “should you base prices on customer value, competition, or cost?” In the world of pricing, there are many schools of thought around this issue and arguments for the benefits and downsides of each baseline can be made convincingly. Because of this, sometimes a quite pragmatic approach on selecting the pricing baseline will help.

In this post, we explore the approaches that can be taken in practical baseline selection in different contexts and situations and will then use this to build a decision framework for navigating the sea of pricing methodology selection.

Price Foundation

The decision on what elements you should base your prices on is one of the most important steps in the price setting process. Your decision should be driven by the goals that are set for the product and where consideration needs to be given, whether it is a new product or if you are resetting the goals of an old product.

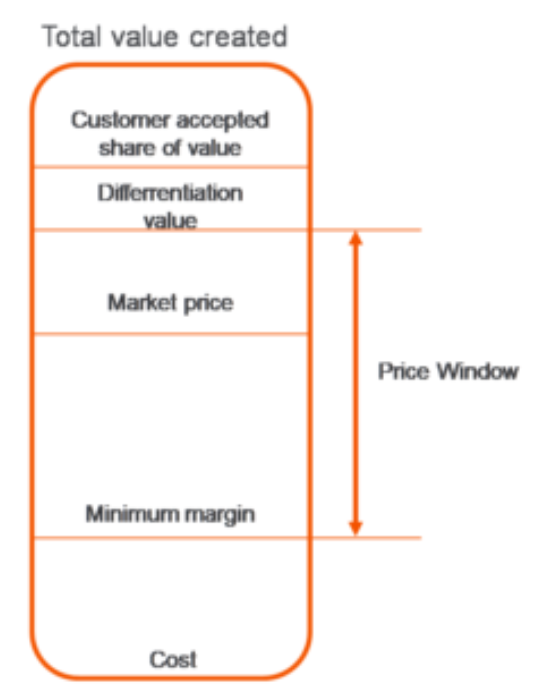

When thinking about the price basis or anchor points for the price, it is helpful to illustrate them in a simple manner, so that they become tangible and easy to visualize. One tool for this is to use an illustration of the price window.

With a price window, it is possible to illustrate concretely what elements need to be considered in setting the price foundation. In practice, one can achieve decent and even good results when focusing on one of the elements only. But by doing so, there is also usually a lot left to chance in the pricing equation. At the other end, of course it would be excellent if every element in the pricing structure can be accurately modelled but doing so for each and every product in the assortment is often an unachievable target. A better and more practical recommendation for calculating the right price is therefore to be aware of all the elements and make a conscious decision about which of them are those that need to be modelled in detail and which can be used on a more general level.

Read: You Don’t Have to Be a Math Whiz When Segmenting for Price Optimization

As a next step, we will take a look at each price basis and check what kind of considerations can be made when selecting either of them as the main baseline.

Customer Value and Willingness to Pay

Taking customer value, or rather customer-perceived value, as your baseline is a very powerful starting point, and some of the most successful pricing approaches have been done from this angle. The inherent difficulty is to quantify the customer value, as it is not something that is set but represents whatever the customers thinks at any given time. This means that most likely there is no single value to represent customer value, but it is something that changes over time and for each customer.

However, this should not be a deterrence from modelling customer value. There are many good books on the tools and techniques regarding this, for example Dollarizing Differentiation Value by Stephen Liozu. These resources can be used as a guide on how to build your own quantification model.

At the same time, there are a few possible pitfalls in using customer value as pricing baseline that need to be considered. One is making the value analysis from an internal perspective using broad assumptions on customer thinking, which do not always correspond to the actual customer perspective, which can lead to grossly over- or under-estimated customer value figures. Even so, selecting customer value as the strongest pricing baseline is a must for products with high sales and margin creation goals, where the effort and investments needed to investigate customer value perceptions can be easily justified.

Read: How to Avoid Price Optimization Pit Falls

Market Price

If the market price level is used as the main baseline for price setting, a key challenge is to correctly assess each product’s position and the differentiation value provided compared to the other market alternatives. It is also important for the pricing model’s accuracy and usefulness to make the evaluation as objectively as possible. One possible solution for verifying the results is to make a competitive value survey for the target industry in order to validate the internal vs external value perceptions. A market price baseline is a good starting point in situations where price comparisons are easy to make and commonly performed and is especially relevant for product segments that customers use to create an overall price level benchmark or impression for the full product range.

Cost

Using cost as the baseline for pricing is very resource effective, as in most cases the cost for a product sold is known. Therefore, it is easy to set up a relationship between cost and price. There are, however, a few obvious, and some not so obvious, potential pitfalls when using cost as a pricing baseline. The most common objection to cost-based pricing is that it does not reflect neither customer value nor market price levels. It could also be argued that when cost is selected as the pricing baseline, the pricing decision, or at least a part of it, is outsourced to the suppliers. And can they really be trusted with this? Do they know how to price the products right?

Furthermore, the commercial models used by different parties across the supply chain can significantly differ. This means that even if the same product is supplied, the price will differ based on the cost differences in the business model and structures used. This is actually one of the most difficult questions to manage in cost-based pricing, i.e. how does one select the right cost? A good guide to this decision can be found in the classic pricing textbook by Thomas Nagle, Strategy and Tactics of Pricing.

Cost-based pricing definitely has its uses and is the right way to go under correct circumstances. One such case is when there is a need for a very simplistic pricing model to be used for setting a vast amount of price points with minimum effort for low-value products which have supportive roles in the product portfolio. However, also in this type of situation, modern software tools can help create the same efficiency, but with a much more fine-tuned pricing approach.

Selecting the Right Pricing Baseline

Given these options and considerations, what aspects should be considered when selecting the best alternative for defining the pricing baseline? Below is a simple and pragmatic framework that helps companies make these initial choices. The purpose here is not to give all the answers for your pricing strategy. Instead, this methodology can serve as a guidebook to help you get started:

- More anchor points are better. Selecting multiple price anchor points is always better than selecting only one. Simply having two anchor points instead of one greatly reduces the risk of making a pricing mistake due to bad input data.

- Prioritize analytical resources. If the products to be priced play an important role in the total product portfolio, and hence there are high expectations on their performance, it is wise to invest more resources in research and analysis to develop the right pricing method and baseline selection.

- Dig for data. What data is available and how can more data be gathered? What resources will this require? Don’t give up easily even if getting to use multiple anchor points seems more difficult.

- Keep it simple. In the end you need to be able to communicate the justification of the price to your customers in simple terms. Consider how potentially complex calculations can be reduced to simple principles.

For a systematic approach to pricing and profitability, download the whitepaper: 5 Best Practices to Take Back Control of Your Pricing.