One of the commercial trends that we have spotted since the outbreak of COVID-19 across multiple industries is that commercial discussions around monetization and Return of Investment (ROI) have got the attention of executives.

It is no surprise how, during and after an economic downturn, initiatives in most organizations are asked to pass through a more stringent commercial screening process to show positive signs they’ll achieve the expected monetization level. This, however, should not be interpreted to mean that organizations should revert to a passive mode, reducing or halting all their innovative initiatives.

One possible remedy for guiding organizations in such uncertain situations, now and in the future? It’s to adopt a “price excellence” mindset. But how can mastery of “price excellence” secure a path for getting the expected monetization level, irrespective of the economic landscape? And what are the steps in this journey?

1. Value management

How is it possible that when two giant automakers like Porsche and Fiat Chrysler (FCA) aspire to launch a new car model, one achieves a roaring success and the other fails miserably?

In 2009 FCA aimed to bring a compact car to the market, a reimagined version of a classic 1970s Dodge. Compacts were a very competitive market segment in which FCA struggled significantly for years. Literally, a die-or-survive moment for the executive team at the time, where the CEO of the time, Sergio Marchionne, repeatedly referred to the Dodge Dart initiative as “Our future hangs on how well we do here”.

The Dodge Dart initiative from day one had the C-level blessing, a rare and ideal situation. Looking at the 90-second TV commercial for the car, not-so-modestly titled “How to Change Cars Forever”, you easily could see this was where FCA was proudly announcing that the money is not an issue; to get a perfect product out, the company is literally kicking out the “finance guys” and the innovation cycle “Think → Design → Reimagine” runs over and over until we receive the perfect product. But, unfortunately, it’s perfect for FCA’s stakeholders and employees, not the customer.

Almost a decade earlier, another leading automaker was grappling with a very similar challenge. Porsche aimed to introduce a car outside its sports car realm, an SUV, a car that does not rhyme with the Porsche brand, which was about speed, power, and daring. Porsche’s top executives were conscious of this risk and, to mitigate it, deliberately designed and built the whole initiative around “price”.

This meant that if customers were not willing to pay a price that significantly increased the ROI, Porsche would have dropped the Cayenne project. Therefore, long before the first concept car rolled out, the Porsche’s product team conducted an extensive set of surveys with potential customers to gauge the appetite and locate the acceptable price range.

They even extended the surveys so they could single out the features that would be important for a Porsche SUV, like a powerful engine, handling performance, and large cup holders. Porsche’s approach was to think about monetization long before product development.

As you have noticed in these very similar initiatives, FCA had a dominated “inside-out” view on “value” and “innovation processes”, whereas Porsche had a clear “outside-in” view. In 2012 the year it launched; the company managed to sell only a quarter of the total predicted by the market analysts. A number that left Dow Jones’s MarketWatch with no room to call it anything else but easily the year’s second-biggest new product flop.

At Porsche in 2012, just a few years after Cayenne’s launch, the SUV accounted for half the company’s total profit, and the famous 911 only generated a third. The main differentiator that led to a very different outcome for these very similar initiatives were the approaches to capture “value” and translating it to products and features that customers were really willing to pay for.

2. Transaction management

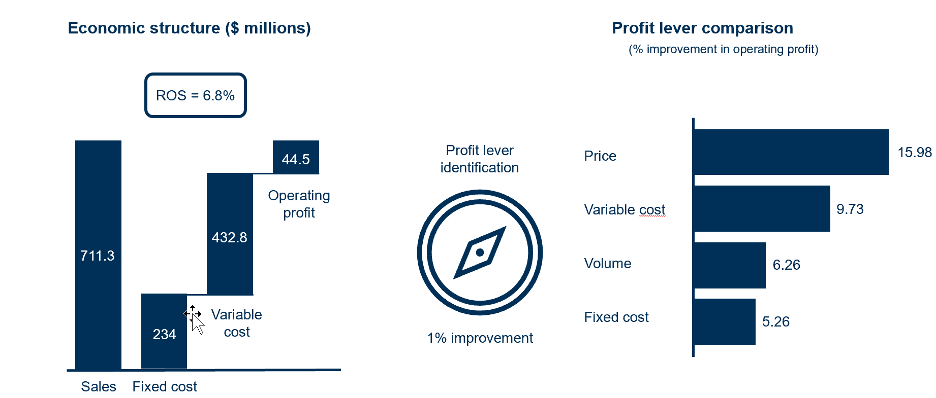

A refrigeration systems manufacturer was in a state of overcapacity and this was crippling its operation. The economics of this enterprise with a ROS of around 6.8%, a slight increase in prices would have a significant impact on the bottom line compared to other levers.

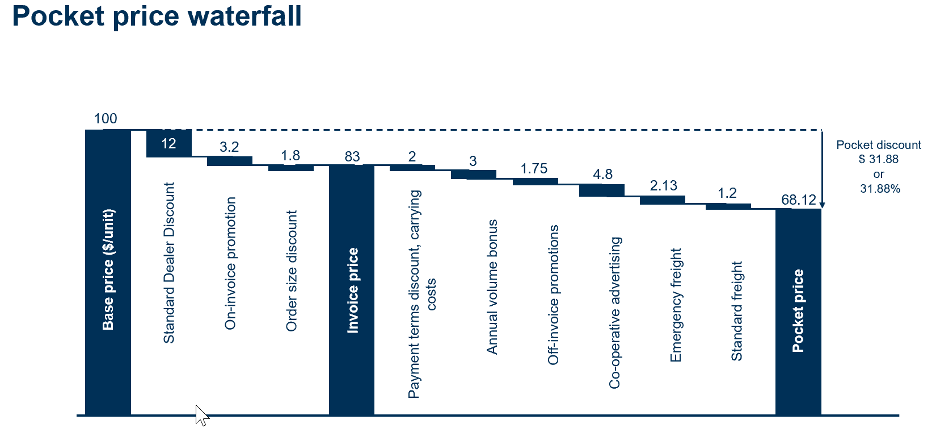

By analysis of the historical transactional data, a significant leakage on the off-invoice side of the price waterfall was discovered.

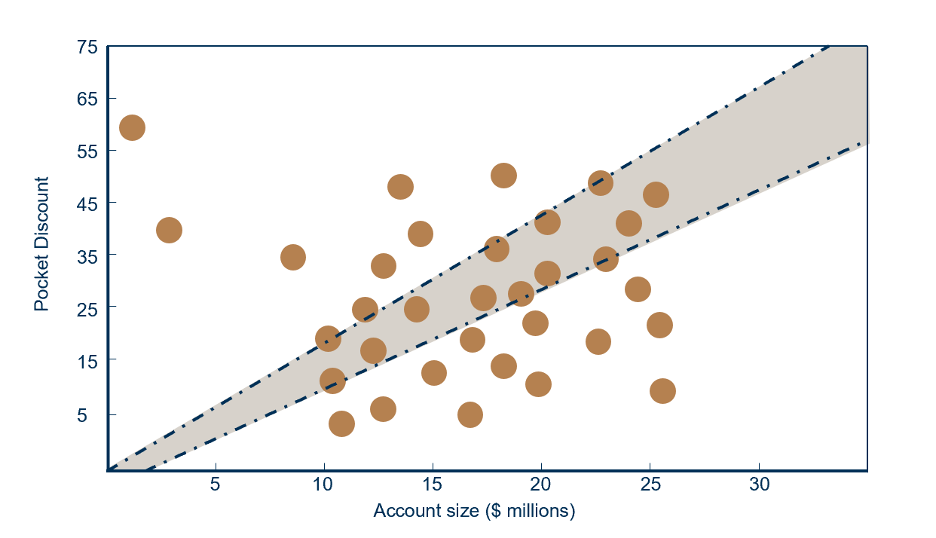

It turned out that there was no direct correlation between the account size and pocket discount level which was the expected pricing policy by the executive team across all sales.

The problem here was the lack of visibility and the absence of structured processes to manage the off-invoice discount elements in conjunction with on-invoice discount elements. This meant that the company is willing to sell high-quality systems to various brands without differentiating its value offerings.

The second step in this price excellence framework aims at setting and getting the right price for each transaction.

3. Market Management

So far, we’ve covered the first two steps toward price excellence; the third step is called Market Management. This step primarily demands a 360-degree overview of the industry that your business operates in, as well as knowing the overall business strategy of your organization, whether it is for market entry, growth, or profitability.

Following this realization, it aims to translate these two assets into the short-term and long-term pricing strategies and policies. This step becomes even more important as organizations grow, considering the potential commercial impact due to the loss of agility to respond to market changes.

Therefore, for organizations at the lower end of maturity spectrums, such as enterprises, this becomes a sort of must-to-have element to be able reap sustainably the benefit out of the first two steps in the price excellence framework over a long term.

But what are the commercial benefits that organizations can achieve by embracing the 3rd step? Organizations can:

- Contribute to an industry-wide upward momentum!

- Outstrip the market on the pricing tactics!

- Identify possible underserved or untapped potential demands in the market!

This step is not easy at all and requires long-term vision, and not having this done properly can create downward pressure on industry prices, and possibly years-long market erosion due to a price war, something that we have seen in the telecom industry over the last 20 years.

How does the typical road to mastery in this step look like? It is indeed not an easy one for most companies, as it requires a long-term perspective, with tough decisions to be made along the way, but we can name a few general best practices that we have seen out there:

A. Map Industry-wide Microeconomics

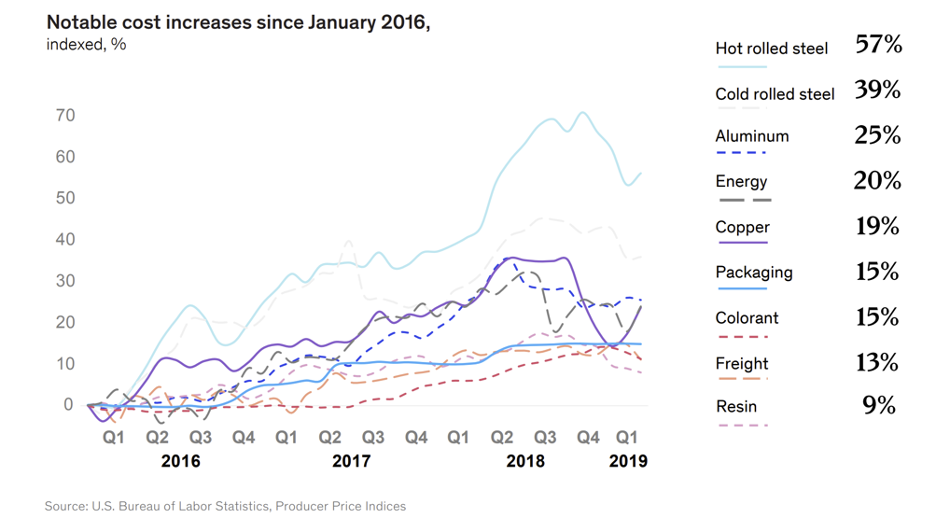

The common drivers in most industries can be cost, supply, or demand. Therefore, companies should proactively plan for expected changes and prepare for ways to have a quick response to the unexpected.

Cost

There might be various reasons that impact the total cost for a product or service such as raw material, as outlined below, or new changes in the manufacturing or distribution or even technology disruption.

Companies should first have business systems in place that allow them to get an updated map of the full cost drivers, as well as ways to quickly spot any changes to these cost drivers. And secondly, processes in place that allow for a quick and well-rounded response from the pricing team to the front-line sales team.

Supply

Companies in those industries where prices are sensitive to changes in supply such as new capacity coming online, patents expiration and plant availability must have processes and systems in place that allow them to make correct decisions on capacity levels to avoid any abrupt price changes.

Demand

Develop insights into future market conditions and demand levels based on a deep understanding of the forces behind total-market demand. For those who are interested in this topic I recommend you have a look at the “Four Steps to Forecast Total Market Demand” by William Barnett.

B. Industry-wide Pricing Conduct

What we have presented so far might help companies to achieve quick wins based on advanced microeconomic analysis on cost, supply, or demand or micro-optimizing contract terms to capitalize on the insight generated. However, the other side of excellence on the market level, often overlooked by companies, are the sustainable pricing policies.

An established, sustainable pricing conduct within an industry benefits all market players over the long-term by avoiding price wars and regular price increases, fairly monetizing the value of innovation. For more information on this topic, I recommend having a look at this interesting article in HBR.

4. Pricing Infrastructure

The fourth and final element is the “pricing infrastructure”. This step is the solidifying agent for all previous steps in this framework. Embracing this step means that organizations know how to:

- Maintain their pricing performance.

- Avoid returning to the status quo after realizing the quick wins and the early improvements.

This step has a few sub-elements, and their implementation answers questions such as:

- What are the processes around price change or discount approval? – What is the structure of a pricing function and what expertise are required in this function?

- What are the KPIs for recognizing and rewarding pricing excellence?

- What systems and tools are required to support pricing excellence?

That’s our glimpse into a four-step pricing excellence framework that is designed to help organizations to get the expected monetization level, irrespective of the economic situation surrounding any initiatives.