Understanding your customers’ willingness to pay is essential for setting optimal prices and maximizing revenue. But how do you calculate a customers’ willingness to pay, and how can you use that information to set effective prices? In this article, Business Consultant, Kalle Aerikkala explores the concept and shares best practices for using it to inform your pricing strategy.

By calculating your customer’s willingness to pay, you can ensure your product’s price is not too high or too low. If the price is too high, your customers may not buy the product; if the price is too low, you may not make enough profit.

What is Willingness to Pay (WTP)?

Your customer’s willingness to pay (WTP) is the maximum amount of money they are willing to spend on your product or service. It represents the value that your customer perceives in your offering. Perceived valuation is influenced by various factors such as budget, alternatives available in the market, and level of satisfaction with your product.

Market research and data can help calculate your customers’ willingness to pay. This information can then be used to build customer profiles that are then the basis for the pricing strategy you choose.

See descriptions of possible pricing strategies in The Guide to Pricing Strategy.

Factors That Influence WTP

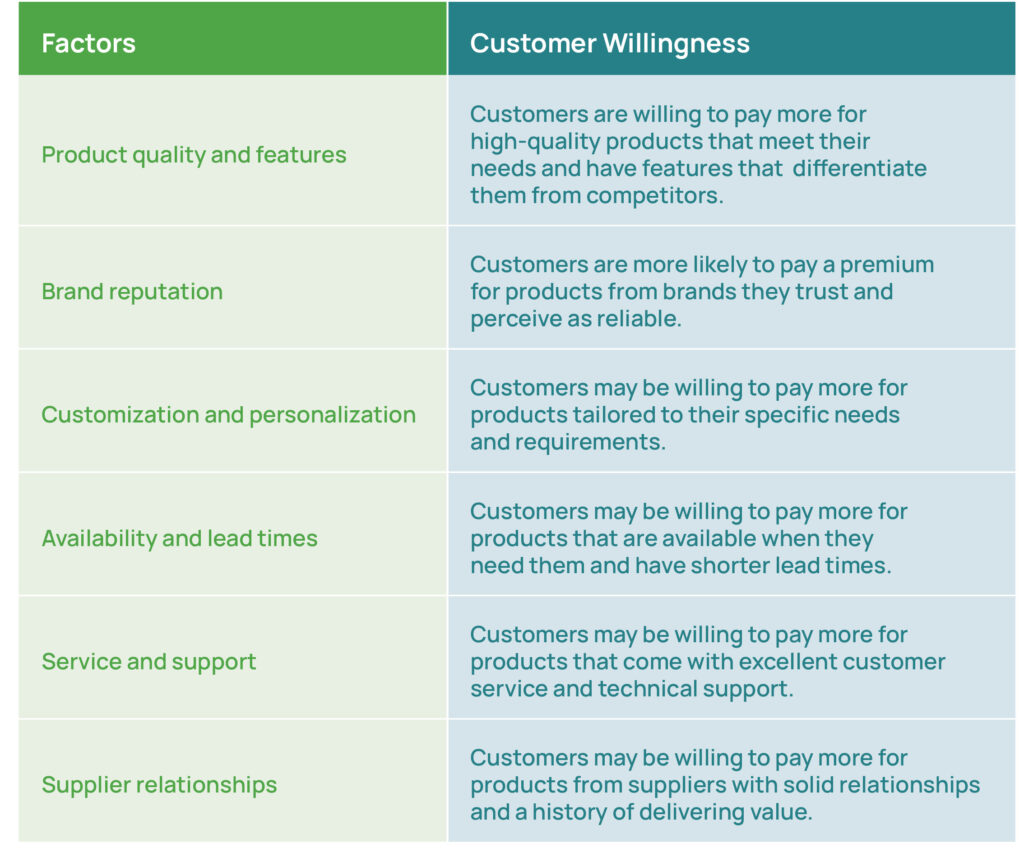

Most manufacturers and distributors face these common factors in willingness to pay:

- Product quality and features – Customers are willing to pay more for high-quality products that meet their needs and have features that differentiate them from competitors.

- Brand reputation – Customers are more likely to pay a premium for products from brands they trust and perceive as reliable.

- Customization and personalization – Customers may be willing to pay more for products tailored to their specific needs and requirements.

- Availability and lead times – Customers’ willingness to pay might be higher for products that are available when they need them and have shorter lead times.

- Service and support – Customers may be willing to pay more for products that come with excellent customer service and technical support.

- Supplier relationships – Customers’ willingness to pay might be higher for products from suppliers with solid relationships and a history of delivering value.

Is Willingness to Pay the Same as Marginal Willingness to Pay?

When considering the factors affecting WTP, especially product features, it is essential to differentiate between concepts of willingness to pay and marginal willingness to pay. Marginal willingness to pay indicates the differences that are based on individual features of your product. This makes marginal willingness to pay a key element when creating your portfolio positioning with pricing. Portfolio positioning is most commonly achieved with list prices.

Read about the fundamentals of list pricing in What is List Pricing?

Why is Understanding WTP Important?

With an understanding of what WTP is, you gain value from different price levels across business segments. These segments are not just groups of different customers but consider various dimensions. The highest agreeable price for your customers will vary over time, place, and specific product features. In addition, the method of purchase and the way the product or service is delivered will impact willingness to pay.

It Takes Market Demand into Consideration

In many manufacturing businesses, customer willingness to pay is related to market demand. Suppose customers of your customer are decreasing their purchases and you want to keep your manufacturing at the same level. In that case, you likely need to find new customers with a lower willingness, or try to capture business from competitors which usually means also capturing customers with a lower willingness. Selecting the most profitable from many alternatives is a vital capability of the sales and pricing organization when matching market demand to varying price levels. You need solid capabilities to analyze your business from a profitability angle to do this.

Learn how to plan a course of profit-growing actions in Why is Profitability Analysis So Important?

WTP Can Drive a Pricing Strategy

Which comes first, a pricing strategy that defines the usage of willingness to pay or the willingness to pay approach that guides the selection of pricing strategy? In many practical cases, this does not have to be a big dilemma. For an existing product business, WTP consideration is often an additional approach used to fine-tuning pricing. For brand-new products, the pricing strategy can be designed from scratch using research, including WTP analysis.

WTP Can Navigate Product Development

Researching the marginal willingness to pay, for example, through conjoint analysis, will provide valuable insight into which product- or service features are most valuable and should see the allocation of product development resources. This research is as essential when developing new products as incrementally improving existing ones or deciding which ones to discontinue. Seamless cooperation between the pricing and product management teams is necessary to make the right decisions.

How to Calculate Willingness to Pay

To make operative pricing decisions when using the WTP, quantify the price differential for each segment. When pricing across many segments however, the analysis and pricing must be automated to make it feasible. There are multiple ways you can research WTP. The conjoint analysis method was already discussed as part of estimating marginal willingness to pay and linking that, especially to product development. Other common research methods include surveys, auctions, and price experiments.

The available methods can be broadly divided into two categories—qualitative research, where results will be quantified by some method, and direct quantitative methods based on business data.

Surveys and Market Research

Surveys are the most common method for qualitative measurement of willingness to pay. Different types of surveys are very cost effective, and it is always possible to gather results that can be quantified. But there are downsides as well. Survey results for pricing are often unreliable, especially in a business-to-business context as the respondents have an incentive to skew the results and the possible pool of respondents is limited. Survey results are most useful when they are used to create indications and categories instead of detailed quantified WTP estimates. This approach makes the survey results easy to combine with data analysis that can be the quantitative method of choice.

Sales Data and Customer Behavior

Historical transactional data enriched with customer, product, and deal attributes can be used to identify business segments with similar WTP characteristics. Combining all these elements is a mandatory element in such analysis, as leaving even one perspective out would reduce the applicability of results. The first step in this analysis is to create the relevant business segments that uniquely capture the differences between willingness to pay. This phase in the analysis is recommended to be automated as it can be very time-consuming if done manually. Good analysis of willingness to pay will also include the survey input by classifying those results and the historical sales data to create unique insight into customer behavior.

Applying Willingness to Pay

Applying the willingness-to-pay method in pricing requires effort but usually pays off handsomely. The prerequisite to the benefit is that the analytics is done on a granular enough level to create relevant and actionable business segments. The other crucial building block is using the prices set through the willingness to pay evaluation process. A specific focus should be put on making sure the prices that are being created are then actually being used in those segments.

For Price Setting

The exact price setting using WTP builds on the business segments created. The detailed price setting should be based on defining the optimum price for each segment. Take care to set the price while considering both the opportunity that can be gained, the likelihood of that happening, and the risk of losing business if making too aggressive price changes.

B2B Examples

An example is often drawn from a consumer business context, but good examples can also be found in a purely B2B approach. One iconic example is a discount policy that is found in almost every sales organization. These policies capture some attributes that affect WTP but often stay at a general level causing the price differentiation to be too small. The most critical action, in this case, is to improve the segmentation to consider more attributes.

Summary and Key Takeaways

Willingness to pay is a broad concept that can be approached from different perspectives, and the practical application will differ based on the exact business situation. Are you improving current pricing or pricing something completely new? That consideration will determine available methods and resulting pricing strategy. However, there are a few common elements that are always relevant.

- Combining systematic data from actual customer transactions with qualitative research will provide the best results when setting prices through the willingness to pay.

- Regardless of your current pricing approach, putting focus on understanding customer willingness to pay at a more detailed level will most likely provide high rewards. Create a roadmap of how to improve your pricing to be more closely aligned with customer willingness to pay.

- To make pricing based on customer willingness to pay operational, consider automating parts of the process, like relevant business segment creation and finding optimal price levels. These are tasks where efficiency is vital to allow focus on getting the overall approach and pricing strategy right.