Inflation is constantly making headlines, and keeping your profitability intact takes more than just raising prices. Smart companies see pricing as a powerful way to grow revenue and manage demand. Dan Cakora, Business Consultant at Vendavo, explains how to tackle inflation in 2025 by staying agile in shifting markets, being transparent and fair to build customer trust, and using precision to fine-tune pricing and protect your margins.

When I ask pricing professionals “why is it important for companies to adjust prices during inflationary times?” most of the time, the first answer is “to maintain profitability.”

Logically, this makes sense. Increasing costs must be passed through to customer prices or margins will shrink. Smaller margins crimp operational flexibility, pressure cash flow, and limit a company’s ability to invest in market differentiators. Margins are the lifeblood of healthy, growing companies, so protecting them is sacrosanct.

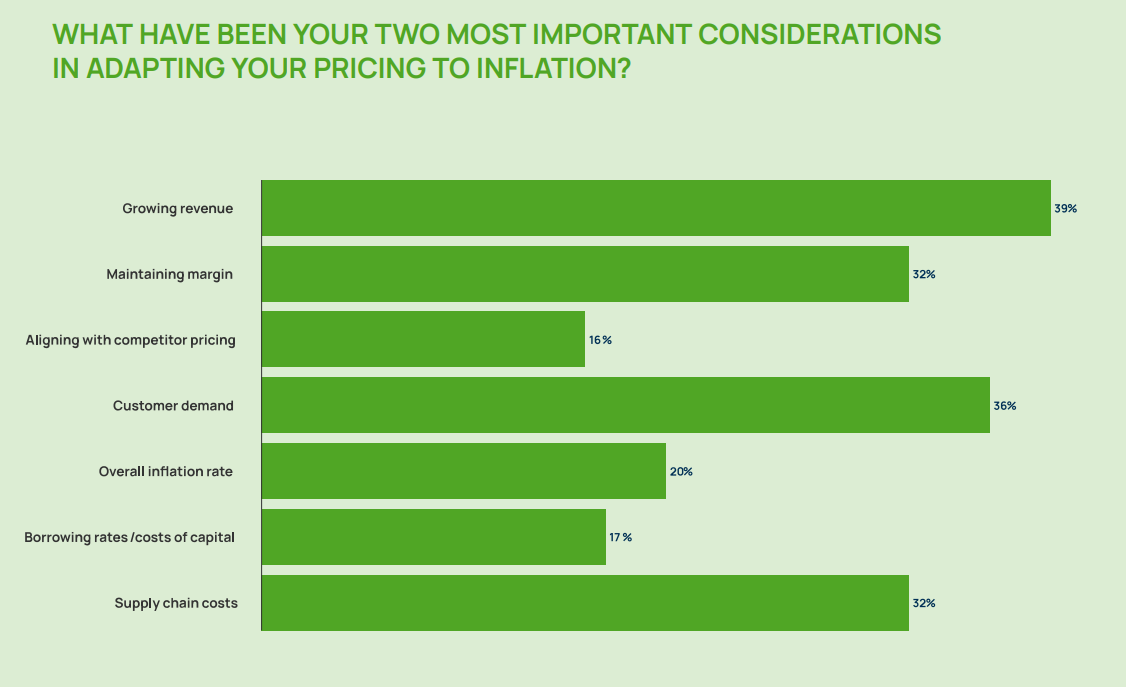

But protecting margins is only one factor in responding to inflation. According to The 2025 Pricing for Profitable Growth Outlook by Vendavo and Experis, “maintaining margin” ranks third among the top reasons executives adjust pricing during inflation, tied with “supply chain costs.” The top two reasons were “growing revenue” and “customer demand.”

Yes, you read that correctly. Pricing departments are not just administrative cost centers that simply getting prices on the page. In fact in recent research, 53% of respondents consider their pricing strategies very effective, while 34% say they are extremely effective. Forward-thinking companies treat pricing as a critical, strategic source of revenue growth. Better pricing grows the bottom line, especially during inflationary periods. There’s a lot of money to be made by charging the right price to the right customer at the right time.

Moreover, adapting prices during inflation – which typically means raising prices – is an effective way to manage customer demand. Here’s how:

- When product availability is low, as it was during pandemic-era supply chain disruptions, companies can use price to balance supply and demand.

- Higher prices prompt customers to re-evaluate their need for product. This naturally reduces demand because it’s too expensive to over-buy.

- Limited supply can be allocated more sensibly among customers who place the highest value on products and services.

- An added side-effect is that higher prices ensure that inventory is available for strategic accounts that may have a near-term need.

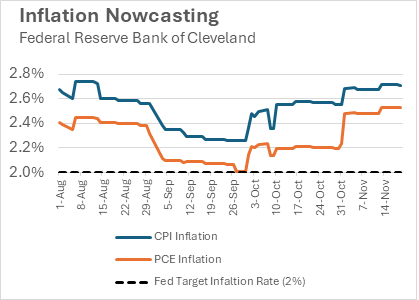

As 2024 comes to a close, the specter of inflation once again looms large. The Federal Reserve Bank of Cleveland’s Inflation Nowcasting, which predicts future Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE), showed inflation nearing the Fed’s 2% target in late September before re-accelerating.

This estimate doesn’t yet factor in the potential impact of economic policies proposed by the incoming Trump administration, such as higher tariffs, deregulation, immigration enforcement, and relaxed antitrust measures. While these policies could drive inflation higher in 2025 and beyond, their actual effects will depend on how closely implemented measures align with campaign promises.

Unstable economic conditions are nothing new. As you navigate inflation in 2025, focus on three key principles: Agility, Transparency and Fairness, and Precision.

Agility

Jason Girzadas, CEO of Deloitte U.S., recently emphasized the importance of embracing the “VUCA” environment – volatile, uncertain, complex, and ambiguous – saying, “This is the new normal. Your job as a leader is to rise above the environment and provide leadership in the face of change.”

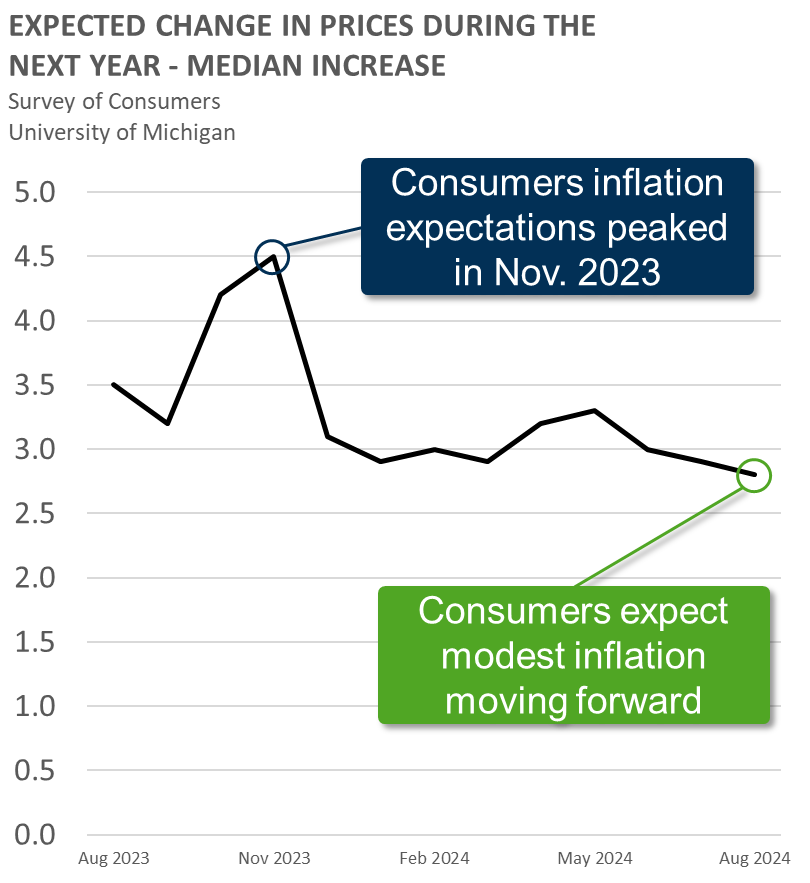

With inflation expectations uncertain for the coming year, executives must prioritize agility to adapt as markets evolve. Leaders like Jamie Dimon, CEO of JPMorgan Chase, use the OODA loop (Observe, Orient, Decide, Act) to navigate uncertainty effectively:

- Observe

Understand the problem by closely monitoring internal factors like supplier costs and external forces, such as supply chain constraints and economic inflation indicators (CPI, PPI, PCE).

- Orient

Analyze the data, consider the facts, and outline potential responses. Pre-planning scenarios (e.g., “If X happens, do Y”) helps reduce bias and accelerate decisions.

- Decide

With facts in hand and options assessed, make a decision. Whether through a committee or an individual, ensure the decision-maker are armed with insights and are prepared to act quickly.

- Act

Execute decisions promptly to avoid delays, especially in a high-inflation environment. Then, restart the OODA loop to stay ahead of evolving conditions.

Transparency and Fairness

According to Gallup, the economy was the most important issue for voters in the 2024 election, with 52% of voters rating the candidates’ positions on the economy as “extremely important.” Exit polls from CBS News show that 75% of voters reported that inflation had caused moderate or severe hardship for them over the past year. Given these sentiments, inflation-driven will be unwelcome to customers who expect pricing stability.

If inflation resurfaces and price increases become necessary, prioritize transparency, fairness, and a shared burden approach:

- Transparent

Clearly communicate the reasons for price changes, such as rising input costs or supply shortages, to avoid appearing arbitrary.

- Fairness

Align price increases with actual cost changes to maintain trust and protect long-term customer relationships. Fairness fosters loyalty even in tough times.

- Shared burden

For key customers, absorb part of the inflationary costs to demonstrate your commitment to long-term partnerships.

Precision

Expect customers to push back against broad price increases like those seen during the pandemic. Instead, leverage transactional data to identify underpriced customers or products and implement targeted price adjustments to correct margins with minimal customer impact. A data-centric approach is easier to defend, reduces bias, improves consistency, and can enhance profitability without over-reaching.

How Vendavo Can Help

Vendavo has been powering the profit transformations of global manufacturers and distributors for more than 25 years. A successful profit transformation requires unified pricing, selling, and rebate management – and that’s what Vendavo does best.

If you need help navigating pricing, reach out to Vendavo. We’re the commercial operating system for the world’s most profitable businesses. Partner with us to move forward confidently. Reach out today to request a demo or speak with an expert about your business needs.