In this article by Business Consultant, Israel Rodrigo, discover the importance of volume curves and how you can optimize them for your business needs.

Originally published: July 19.2023

Updated: November 25, 2025

In my prior article on volume discounts, we illustrated the ways companies can architect their commercial strategies, so they can incentivize customers’ buying behaviors.

Many companies spend most of their time and effort in the planning stage, discussing and designing pricing strategy. Often, less is done around the actual pricing execution and effective price realization. The most adaptive pricing organizations, will spend most of their time on techniques that quantify the value against next alternative options.

There are many ways to deliver value by designing pricing mechanisms (subscriptions, monetization of cheap equipment vs their more expensive consumables, freemium, etc) but these mechanisms only work if they are supported with advanced segmentation based on customer behavior and a dynamic pricing execution framework.

In order to capture value at scale, organizations need a robust pricing execution framework that couples pricing discipline governance with advanced technological capabilities.The same concept applies to volume discount commercial policies.

What is Price Curve Optimization?

Price curve optimization involves taking a look at previous transactions and figuring out how price and purchasing behavior interact with one another. Companies are able to utilize past transactions and historical data to determine a price that’s optimized for greater win rates and profitably maximizes revenue.

Predictive models are built by analyzing different price points and how they impact customer behavior. This data-driven approach determines price elasticity and which customer segments are purchasable at a particular price.

The optimization part means using that curve to land at the price point where you capture the most value while still winning the business you want. No leaving money on the table with unnecessary discounts. No losing deals because your price was slightly out of reach. You get data-driven guidance that tells your sales team where the sweet spot sits for each opportunity.

Why The Price Curve Matters

Sales teams all too frequently let lost revenue slip through the cracks. They either offer too many discounts where they could maintain higher pricing, or they don’t budge on price and subsequently lose sales to competitors with more flexibility.

Price curve optimization changes this, providing the data backbone to compute the intersection where your margins are protected and your pricing remains competitive. Here’s how it works in practice.

- Stopping the discount death spiral: When sales reps are guesstimating discounts, they usually give out too much. Price curves indicate the minimum discount necessary to win the deal, so you stop leaving money on the table.

- Aligning sales incentives with profit: Your sales team gets granular direction on where to push and where to give. No more hurting margins in the name of volumetric approval of the deal.

- Scale pricing decisions across thousands of deals: When you have a high B2B transaction volume, you can’t manually go through each quote. Enhanced optimized price curves give you the ability to leverage smart pricing strategies in an automated fashion at scale.

- Structure deals with confidence. Know which levers to pull or push with volume commitments, service bundles, and payment terms, rather than reflexively cutting prices.

- Gain competitive leverage without racing to the bottom. Price optimization gives you the tools to avoid pricing yourself out of a profitable deal.

You can see exactly how to set prices to be competitive and where you have room to capture more value. The bottom line is simple. Price curve optimization turns pricing from guesswork into a strategic advantage.

What are Volume Curves?

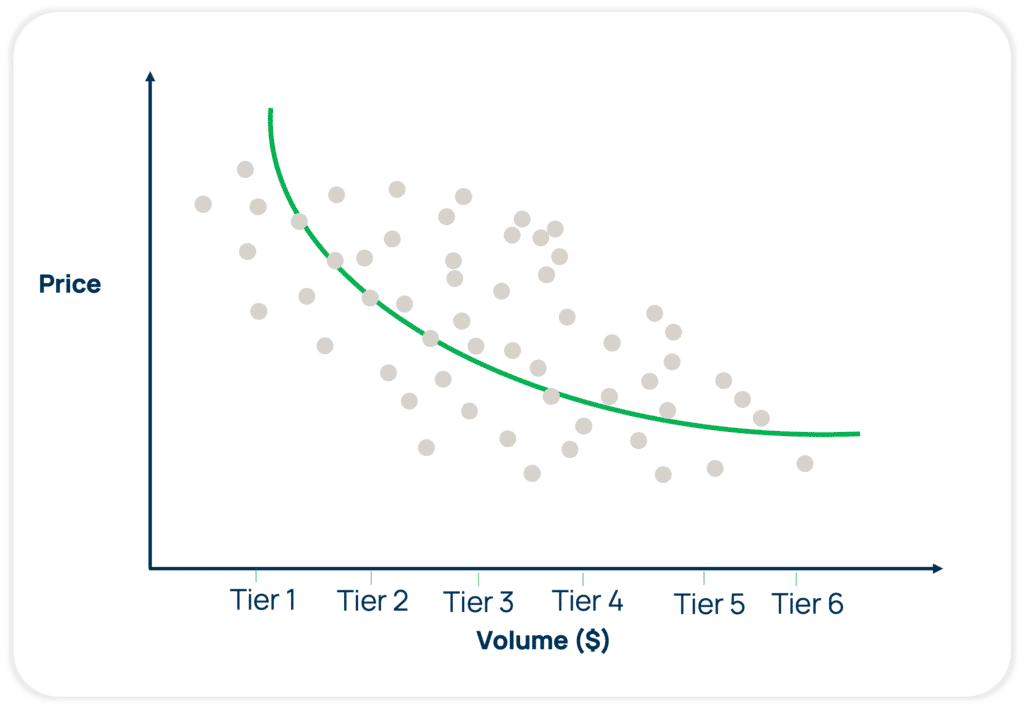

Volume-based discount curves, or tiered-pricing policies, were developed to optimize sales and margin opportunities, balancing price realization and risk between the buyer and the seller.

The idea is simple: if a customer buys more volume, we can discount the product or services further and incentivize the purchase of more units.

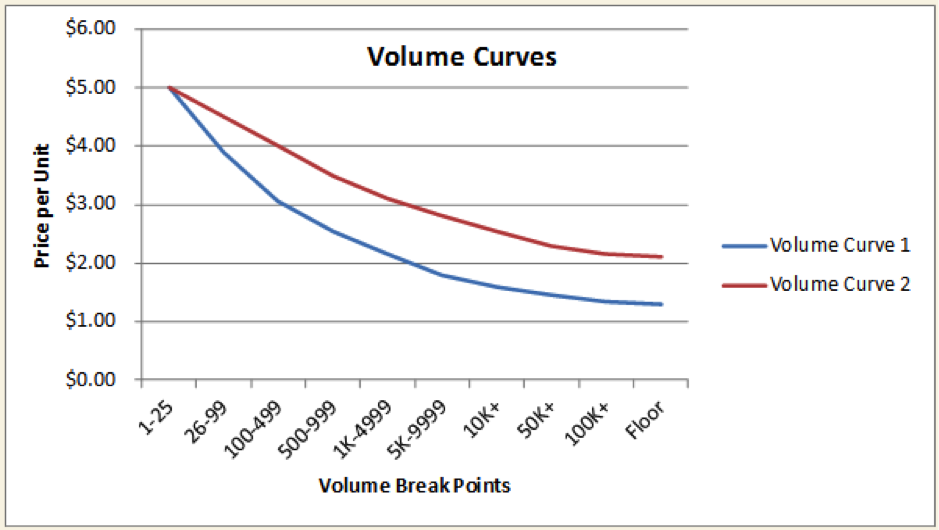

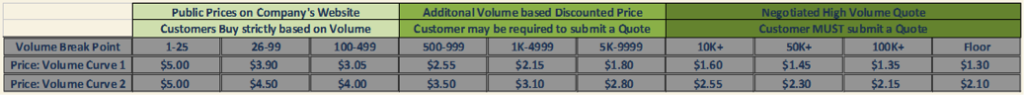

Your company likely has a standard set of curves with “volume breaks or tiers” which may have some resemblance to the image below.

Theoretical Foundations & Pricing Curve Models

Price curve optimization relies on one core economic principle: demand elasticity. Demand elasticity shows how sensitive customer demand is to price. Products that exhibit high elasticity mean that even the smallest price change can lead to large shifts in volume demand. With Inelastic products, shifts in demand volume are small regardless of price changes.

The relationship between price and volume is what economists have termed the demand curve, and this can be thought of as a line that shows the volume that will be sold for each given price point on the market. You can visualize this as a line showing how many units sell at each price point. Most B2B companies discover their demand curves fall into one of two categories: linear or non-linear.

Linear vs Non-Linear Models

Linear demand curves assume a constant rate of change. Drop your price by 10% and you might see a predictable 15% bump in volume. The math is straightforward, and the model works well when you have limited historical data or relatively stable market conditions.

Non-linear curves (often called constant elasticity models) capture more complex customer behavior. They use logarithmic functions to show that price sensitivity shifts at different price ranges. A 5% discount at the high end might barely move the needle. That same 5% cut in a more competitive price zone could trigger significant volume gains.

Stepped vs Smooth Curves

In practice, you will encounter two distinct curve patterns. Stepped curves show discrete jumps in demand at specific price thresholds. The classic example is the psychological price barrier, where dropping from $101 to $99 appeals to a new customer segment that wouldn’t have bought at $100.

Conversely, smooth curves represent a more gradual change in demand across the full price spectrum. Each small price adjustment brings in a marginal set of new buyers without dramatic volume shifts. The curve shape you see depends heavily on your market structure and customer segmentation.

Cross-Price Effects

Other more advanced models account for more than just the elasticity for a single product. Base pricing models consider cross-price elasticity, where a change in pricing for one product will affect demand for another product. Cannibalization occurs when a lower price for Product A steals sales from Product B. The halo effect works in reverse, where pricing one product purposely uplifts demand for the entire portfolio.

What is the Goal of Policy Optimization?

The goal of policy optimization is to support and improve target pricing in environments where certain pricing policies play a critical role. These situations are typically centered around volume pricing – by quantity annual volume commitment, or customer size – SKU premiums, or attribute pricing. Volume discount curves are an example of policy optimization.

Conceptually, by properly utilizing and monitoring volume curves, businesses with an array of product lines and customer buying levels, can tune their pricing to better fit their situation.

The Challenges & Risks of Price Curve Optimization

Price curve optimization promises better margins and smarter deal decisions. However, there are several implementation issues that could lead to worse pricing outcomes.

- Undefined Volume Pricing Policies: A large number of B2B companies leave volume discounts at the discretion of sales without defining policies or conducting regular assessments. This creates a death spiral in which reps compete on discount prices instead of value. Without guardrails, your price curves just codify bad behavior from the past and bake it into future deals.

- Unmanaged Discretionary Discounting: When sales teams can override pricing guidance at will, your optimization work becomes meaningless. List price increases get absorbed by bigger discounts. Chaos in the field means executives have no visibility into what prices actually close deals.

- Segmentation Breakdown: Historical data only works when past patterns predict future behavior. But bad segmentation perpetuates itself. Volume tiers fail when deal sizes shift outside historical ranges, and too many segments create unmanageable complexity that no one can execute against.

- Improper Technology Adoption: Implementing price optimization without fixing underlying system chaos sets you up for failure. Legacy systems cannot support advanced analytics. Data sits in silos that require manual aggregation and cleaning. The technology becomes a black box that sales teams distrust and work around.

- Over-Reliance on Historical Data: Using transaction history as your only input locks past mistakes into future pricing. Market conditions shift. Competitive dynamics evolve. If your curves only reflect what happened before, they miss what customers will accept now.

- Sales Team Resistance: Reps who do not understand or trust the pricing model will sabotage it through discretionary discounting. They need fluency in the new approach and confidence that it helps them win. Without buy-in, your optimization engine sits idle while deals get priced the old way.

- Complexity Without Transparency: Sophisticated algorithms can produce recommendations that no one understands or can explain to customers. When B2B pricing strategies take the shape of a black box, sales leadership loses confidence. Business teams hesitate to adopt recommendations they cannot justify or defend.

How Can Manufacturers and Distributors Make Volume-Discount Pricing Improvements?

While some companies have well defined volume price/discount curves and policies in place, others have crudely defined and infrequently reviewed policies. Improvements can be made by adopting a Smart Pricing approach that combines data-based segmentation and pricing optimization.

This approach will help you create meaningful pricing guidance for sales teams, ultimately adding revenue to your bottom line.

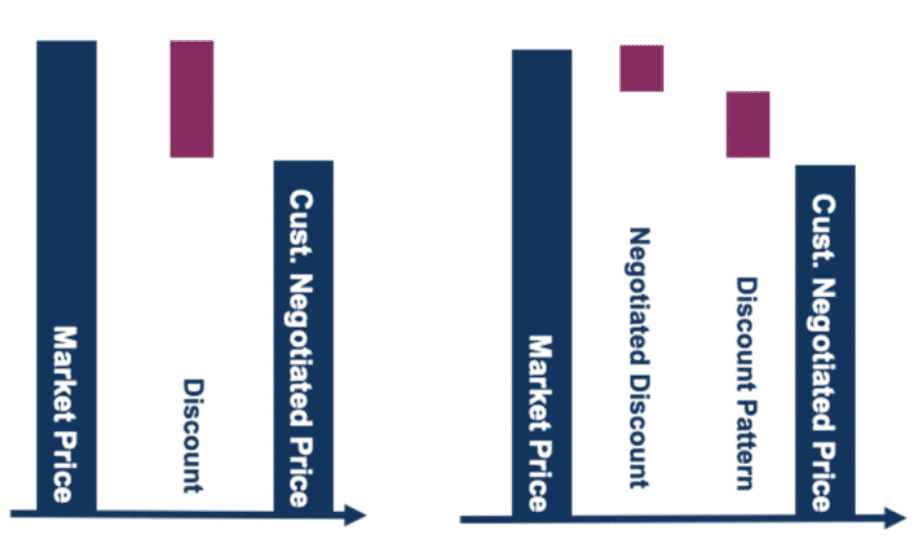

Margins increase when volume discounts are not considered in the negotiation process. Negotiated discounts have a more implicit customer willingness to pay for your products whereas a volume-based discount aims to incentivize purchasing patterns and larger quantity orders.

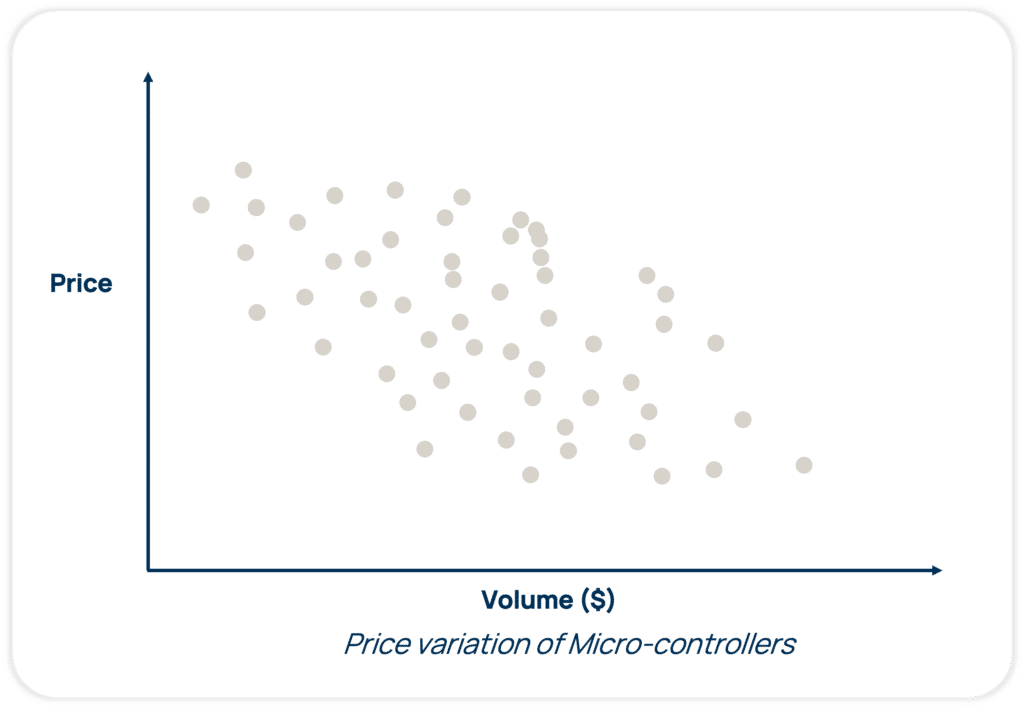

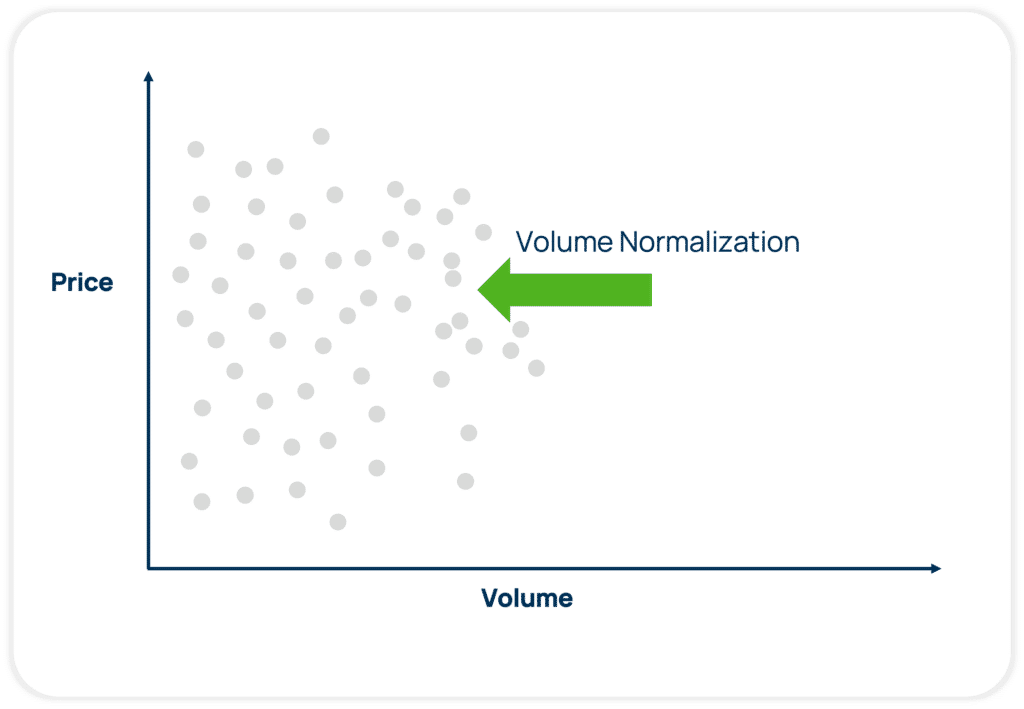

The figure above shows that customers’ willingness to pay for the same product varies, irrespective of the order size.

To achieve this result, we isolate the impact of volume discounting from the segmentation and price optimization model before integrating them into CPQ or CRM systems.

By breaking down tiered discounts and customer willingness to pay separately, we can customize commercial policies effectively and maximize value capture.

Understanding Volume Discounts and Their Impact on Segmentation

Negotiated Discount = Total Discount – Volume Discount

Understanding your volume discount and its impact on segmentation is vital for long-term success. By isolating the volume-defined discount element from the total discount, segmentation based on Willingness-to-Pay can be established using the negotiated discount element:

Total Discount = Policy Discount + Negotiated Discount

This approach involves considering two categories, with sales focusing their discounting efforts on the negotiated discounts. In the example below, we are normalizing the total discount for the volume-related discount effect. This allows us to accurately measure and assess customer willingness to pay once the volume discount dependency is eliminated.

Ignoring volume effects with discounts and margin leads to an invalid comparison of offered discounts. It is apples to oranges. Considering volume effects from the beginning results in improved segmentation, leading to better pricing guidance. This, in turn, translates to increased sales opportunities and higher profit margins.

Price Curve Metrics & Frameworks for Analysis

You cannot optimize what you do not measure. The right metrics turn price curve analysis from a theoretical exercise into a decision-making engine that drives real margin improvement. Below are the core frameworks that are of most value.

- Contribution Margin per Unit: This reveals the level of profits earned per individual sale after the variable costs are incurred. It’s determined by the equation: selling price minus variable costs per unit. This should be tracked across customer groups to identify profitable segments versus where you just chase revenue.

- Discount Curve Impact on Margin: Map out how each percentage point of discount erodes your profitability. A 10% discount does not mean a 10% margin hit. It often cuts far deeper depending on your cost structure. Understanding this relationship keeps sales teams from casually giving away profit.

- Price Volume Mix (PVM) Analysis: This important method analyzes changes in revenue into the three constituent parts. The equation Revenue Change = (Price Effect) + (Volume Effect) + (Mix Effect) can be used to identify the cause of shifts in revenue. It can influence pricing decisions, changes in the volume of sales, or changes in the mix of products sold.

- Price Elasticity and Response: Measure how demand shifts when price moves. Calculate it as a percentage change in quantity divided by a percentage change in price. An elasticity of -2.0 means a 10% price cut drives a 20% volume increase. This metric tells you whether aggressive pricing actually pays off.

- Win Rate by Price Band: Track your deal closure rates across different discount levels. If you win 85% of deals at 15% off but only 40% at 5% off, you have a pricing calibration problem. This metric reveals where your pricing sits relative to competitive alternatives.

- Deal Quality Score: Create a composite metric that encompasses margin, payment terms, volume commitment, etc., to evaluate every transaction. Estimators that use machine learning or advanced pricing software can automate this process to help reps focus on the most valuable deals at every moment.

- Customer Lifetime Value to Price Ratio: Compare what a customer pays upfront against their total projected value. This helps you decide when to discount aggressively to win strategic accounts versus when to hold firm on pricing.

The beauty in metrics like PVM is that they can be applied to any revenue category (e.g., customer, sales channel, region, etc.) According to FTI Consulting, “The PVM calculation works the same for any category and can be applied to multiple categories at once, although Mix becomes more difficult to interpret with each added category.”

How Technology Supports and Optimizes Volume-Based Discounting Policies

Volume curves play a crucial role in pricing and require separate management for consistency and pricing clarity.

The volume curve policy serves as the foundation for an intelligent decision support system, empowering users to apply more realistic negotiated discounts. It’s essential to distinguish between the list price at volume (driven by policy) and the negotiated discount.

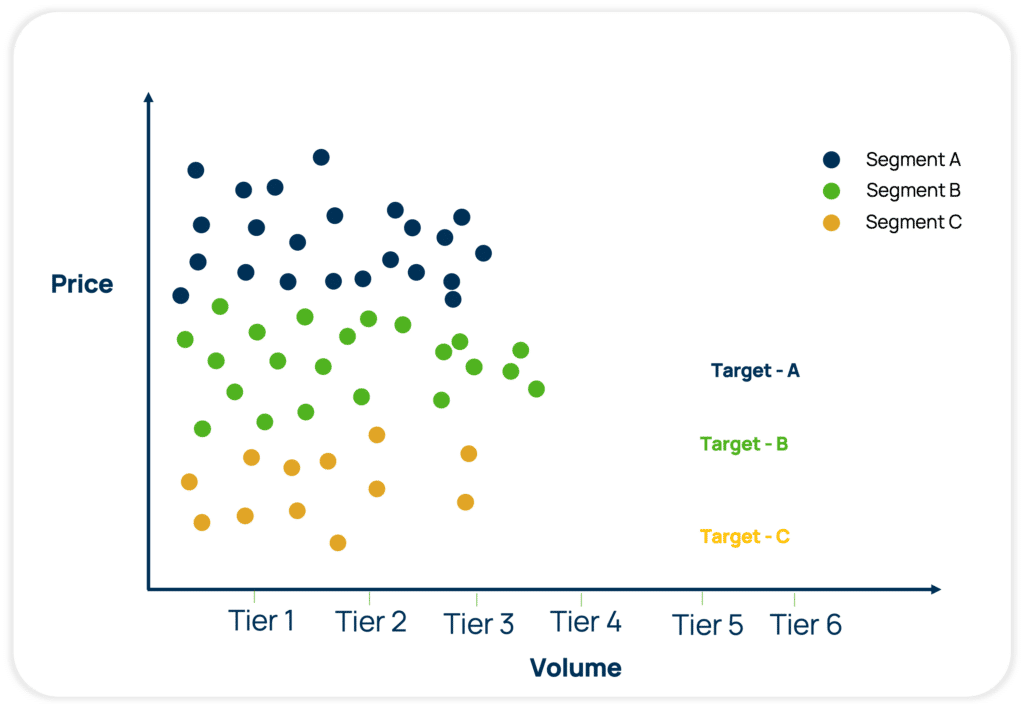

Smart pricing enables companies to set prices scientifically, utilizing statistical, data-driven segmentation. By grouping transactions based on similar willingness to pay, considering relevant categories of customers and products, an optimized target price range can be determined.

How Do Volume Curve Discounts Determine Sales Negotiations?

In pricing segmentation, volume curve discounts play a vital role in determining sales negotiations.

With AI-enabled pricing segmentation, companies can create more precise pricing guidance, catering to specific customers’ willingness-to-pay. This empowers sales teams with immediate access to floors, target, and stretch prices for approval.

How Can Price Optimization Solutions Enhance Volume Policies?

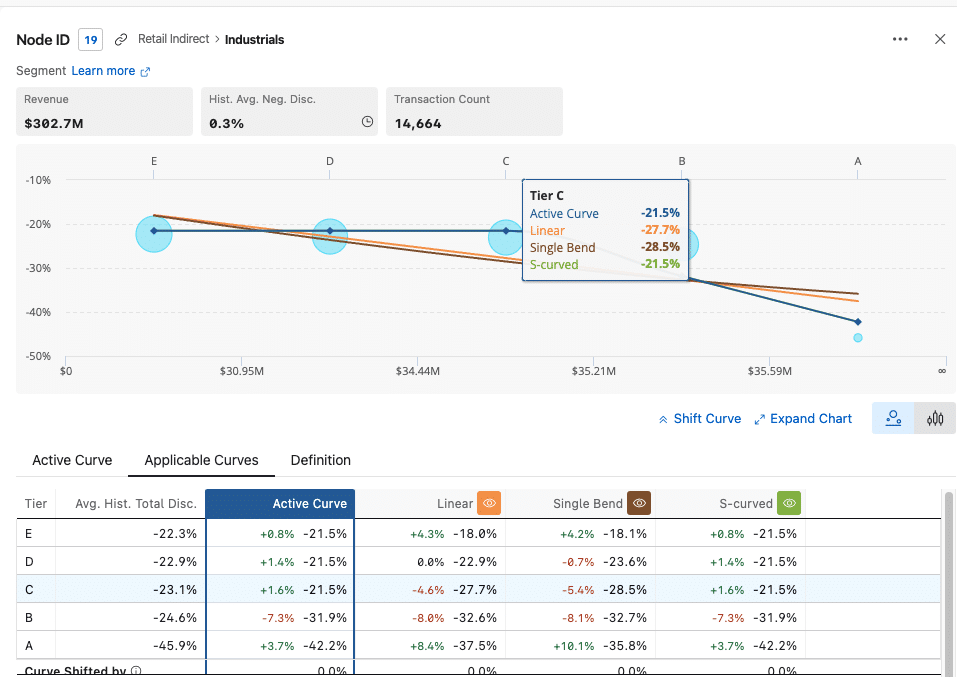

Leading price optimization solutions, powered by advanced algorithmic models, AI, and process automation, help define and continuously refine segmentation models. Establishing logical price/volume positioning through volume clusters (tiers) is a prerequisite for volume optimization modeling. At Vendavo, our Price optimization solution adds statistical rigor to derive volume policies while offering customers flexibility to fine-tune or override these policies based on business insights.

By accounting for volume separately, pricing managers, analysts, and teams can provide enhanced price guidance for Sales, considering both willingness to pay and volume. Below is an example of a volume/tier price curve optimization.

Lessons Learned from Successful Volume-Curve Optimization Policies

Next, we’ll provide an example of a hybrid clustering-based algorithm that cleverly merges statistics with business intelligence to effectively derive volume clusters.

The figure above illustrates two curves, representing either different product lines or the same product line under normal or competitive/aggressive business scenarios. The accompanying table displays internal policies corresponding to various volume break points.

The table above shows three sets of break points: 1-25, 26-99, and 100-499, catering to low volume customers accessing the company’s website. The next set includes break points from 500-999, 1K-4999, and 5K-9999, designed to incentivize additional volume purchases through partner portals. The final set (10K+ and above) operates in a negotiated B2B environment, incorporating various factors for a custom discount on top of the volume policy discount.

In my experience working with customers across different industries, I’ve observed variations in curve designs. Some opt for simplicity, using only a few volume curves for their entire product line, while others create unique curves for each product line or parent family, resulting in multiple maintenance tasks. Some companies find a middle ground, balancing simplicity and complexity.

When creating and implementing volume curves, several factors come into play. Notably, two crucial aspects to consider are:

- Evaluate your volume curves periodically to make sure the intended purpose is served

- Distinguish between the volume curve discount (list price at volume) and negotiated discount

Evaluate Volume Curves Periodically

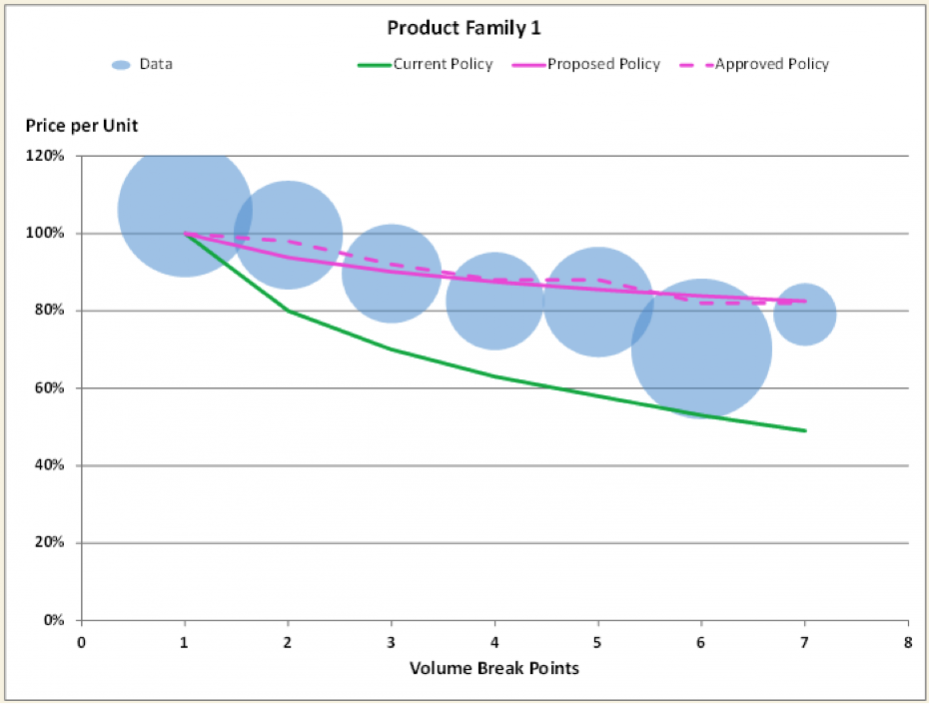

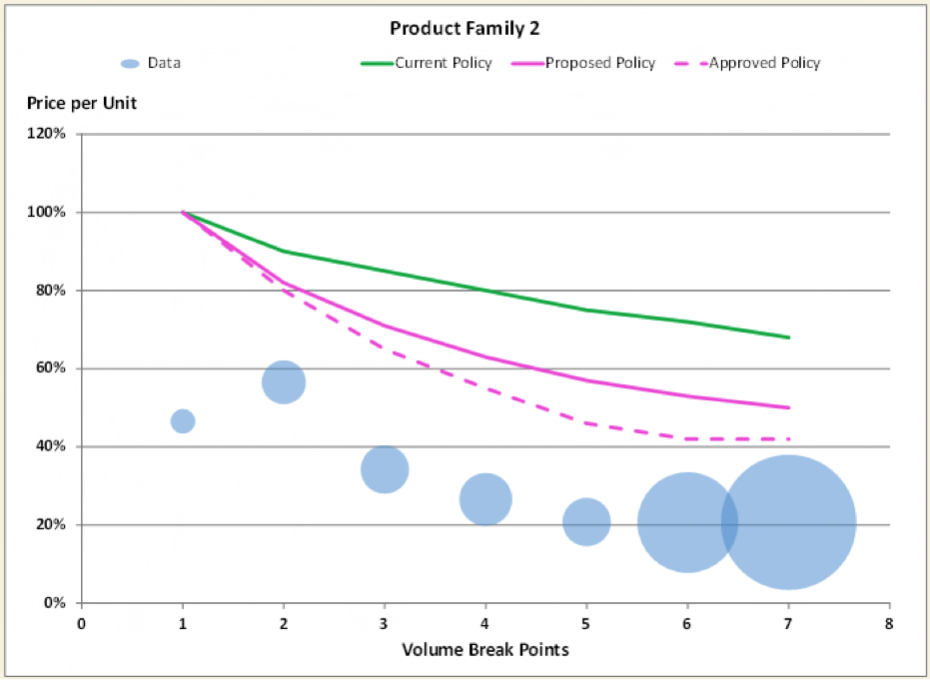

Things change, so you must be prepared for any scenario. Let’s look at two simplified examples where the volume curves may need to be adjusted periodically. But first, some important definitions:

- Data: Actual recognized revenue against each volume tier and corresponding discount from the list price or some common reference price

- Current Policy: Current volume discount policy based on volume breaks

- Approved Policy: The result of user reviewed and implemented discount (can include volume discount and negotiated discount in some cases)

- Proposed Policy: The result of optimization algorithm (statistical analysis) recommending where the volume discount policy should reside

Example 1. Decreased Discounts from the Current Policy in Place

Example 1 demonstrates a scenario where the current policy grants volume discounts at a steep rate. However, the approved policy, derived from transaction data, indicates the need to decrease these discounts. Statistical analysis can help recommend the optimal slope for the proposed policy curve. This analysis is relevant for specific product subsets or when evaluating and refining outdated policies due to changing market and business conditions.

Example 2. Increased Discounts from the Current Policy in Place

In Example 2, a different product family has a current policy with standard volume discounts. However, the approved policy, based on transaction data, indicates the need to increase these discounts to align with competitive market conditions. Statistical analysis helps determine the optimal slope for the proposed policy curve, providing flexibility to apply negotiated discounts for each customer deal.

Distinguish Between the Volume Curve Discount and Negotiated Discount

When implementing volume-based discount policies, it’s crucial to distinguish between the volume curve discount and the negotiated discount. By understanding these components, you can optimize your pricing strategies effectively.

Negotiated Price = List Price @ Volume + Negotiated Discount

In summary, here are three key areas to keep on mind for a successful execution of volume based discount policies.

1. Customer and Product Segmentation

Effective customer and product segmentation enables value-based pricing strategies, incorporating differentiation based on product tiers (good, better, best) and customer value contributions (high, medium, low). Implementing price-volume discount recommendation envelopes provides valuable insights into price sensitivity and profitability at the segment level.

2. Dynamic Execution

The ability to swiftly respond to market dynamics, such as cost changes and competitor moves, is crucial for successful volume-based discount policies. Implementing a governance framework ensures control while adjusting pricing decisions in accordance with industry dynamics, irrespective of company maturity.

3. Aligned Sales Incentives

Sales incentives should be linked to business value and customer compliance. Standardizing discount levels and tiers within a clear governance process helps manage escalations and exceptions. Aligning incentives with market share and success metrics across different channels drives optimal pricing and sales effectiveness, resulting in acquiring the right customers at the right price.

FAQs

What is a price-volume discount curve?

A price-volume discount curve maps out how unit prices decrease as purchase quantities increase across defined tiers or thresholds. It shows the relationship between order size and the discount rate you offer, helping sales teams understand exactly what pricing applies at each volume level. Most B2B companies structure these as tiered models where specific quantity ranges trigger progressively deeper discounts.

How do you isolate volume discounts from negotiated discounts?

Begin tagging discounts using your CRM or pricing system’s triggered mechanisms at the transactional level. Automatic volume discounts are applied as you cross quantity thresholds, while overridden or approved discounts are negotiated as they require manual intervention. A clean historical dataset allows you to clearly differentiate analyses of the types of discounts to determine which one leads to margin erosion, as well as the one that gives you strategic wins.

When should an organization review its volume pricing tiers?

Review your volume tiers quarterly if you operate in fast-moving markets where competitive dynamics shift rapidly. At a minimum, conduct an annual deep analysis that examines win rates, margin performance, and whether deal sizes have migrated outside your current tier structure. Trigger an immediate review when you see systematic patterns of discounting beyond policy or when new competitors disrupt your market positioning.

What metrics should I monitor for price curve optimization?

Your most important metrics should include contribution margin per unit, win rate by price band, and price elasticity. To determine how each percentage of discount affects margin profitability, monitor the discount curve’s impact on margin. Instead of focusing on short-term wins, deal quality scores and customer lifetime value ratios should be included so that you can be sure you are optimizing for long-term value.

How does technology support volume curve policy enforcement?

Modern CPQ and pricing platforms embed approved volume tiers directly into the quoting workflow, automatically calculating discounts based on the quantity entered. The system flags deals that fall outside policy boundaries and routes them for approval before quotes go to customers. Advanced platforms use machine learning to provide real-time guidance that steers reps toward optimal pricing while still allowing justified exceptions with proper documentation.

Optimize Your Pricing Strategy with Vendavo

Price curve optimization is part of a broader pricing strategy aimed at achieving sustainable margin growth. Discover how you can integrate market intelligence, customer segmentation, and analytics to build a competitive pricing strategy. With the right approach, you can leverage pricing as your strongest competitive differentiator.