Do you sell through distribution but negotiate special end-customer pricing that then results in a difference payment to your distributor? Is there a difference between the special end-customer price and the distributor’s standard into stock price? If your answer to these questions is yes, this best practice discussion is for you.

Originally published: April 28, 2023

Updated: August 25, 2025

What is a Special Pricing Agreement (SPA)?

A Special Pricing Agreement (SPA) is a contractual discount between a supplier and channel partner that provides preferential pricing on specific products or product categories. These agreements typically involve rebates, off-invoice discounts, or other price concessions to help channel partners compete more effectively in their markets.

SPAs are a bridge between manufacturers and their distribution channels. They allow suppliers to offer competitive pricing while maintaining control over their pricing strategy across different market segments.

There are many different names for special pricing agreement programs. The most commonly used synonyms include SPA process, off-invoice discounts, ship & debit (S&D), POD, billbacks, and rebate programs. You might have heard of these:

- SPA Process – The standard term for Special Pricing Agreements, widely used across industriesshort form for Special Price Agreement, this is probably the most common

- S&D – Ship & Debit, commonly used in short for “Ship & Debit” and common in high- tech sectors

- POD – Proof of Delivery or short for Proof of Delivery / Price on Delivery, and common in consumer-packaged goods and packaging

- Off-invoice discountsChargebacks – Direct price reductions applied at the point of salecommon in medtech

- Billbacks – Retroactive billing adjustments, common in wholesale distribution

- CUPS – short for Credit Upon Proof of Sale

- Supported Price Process – also known as rebate programs or volume-based incentives paid after purchase confirmation

“SPAs are commonly used in B2B engagements where a supplier may offer special pricing to a particular customer in exchange for a long-term commitment or a guaranteed volume of business,” says Paul Sansom, Business Consultant at Vendavo. “They can provide a level of predictability and stability in channel pricing for both the supplier and the customer, helping establish a mutually beneficial relationship.”

Some of the key features of special pricing agreements include:

- Contractual framework – Formal agreements that outline pricing terms, eligibility criteria, and performance requirements

- Volume thresholds – Minimum purchase quantities or sales targets that trigger special pricing

- Time-bound periods – Specific start and end dates for pricing programs with defined review cycles

- Product scope – Clear definition of which products or product categories qualify for special pricing

- Performance metrics – Measurable criteria such as percent of market share, revenue growth, customer acquisition, or sales velocity

- Compliance requirements – Documentation and reporting standards that partners must meet to maintain pricing benefits

As the number of rebate programs grows and the complexity of SPAs increases, “managing all of the accruals, claims, and payments can quickly become a daunting task if performed manually,” warns Sansom.

How SPAs Work

Special Pricing Agreements follow a structured process that ensures both suppliers and channel partners benefit from the arrangement while maintaining proper controls and documentation.

- Negotiation – The manufacturer and distributor establish the contractual framework for the SPA. This includes defining pricing tiers, volume commitments, product scope, and performance expectations that both parties must meet.

- Quote Submission – The channel partner submits a quote to their end-customer using the pre-negotiated SPA pricing. The quote reflects the special discount while ensuring the partner can remain competitive in their market.

- Deal Execution – The customer accepts the quote and finalizes the purchase at the agreed price. The distributor processes the sale and delivers the products according to the contract terms.

- Claim & Validation – The distributor files a reimbursement claim with supporting documentation such as invoices and proof of delivery. The manufacturer reviews and validates that the claim meets all SPA requirements before approval.

- Rebate Payment & Reconciliation – The manufacturer processes the rebate payment to the distributor and updates performance tracking systems. Both parties reconcile their records to ensure accurate accounting and prepare for future SPA cycles.

This approach ensures transparency and accountability throughout the SPA lifecycle. When executed properly, these agreements become a powerful tool for revenue optimization that strengthens manufacturer-distributor relationships while driving market growth.

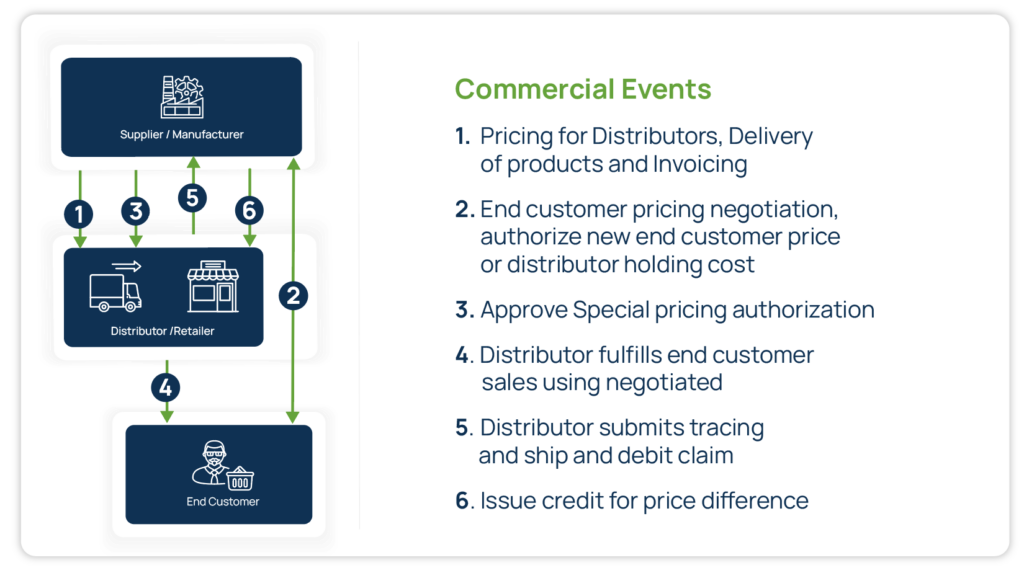

Common SPA Process Flow

A manufacturer has an established standard price that is common across all distributors, or they have a specific negotiated “into-stock” price for each distributor. Products are delivered into the distribution channel at this standard pricing.

- A sales organization negotiates an end-customer price for the purchase of an item. The sales organization might be a manufacturer direct sales team, a distributor sales team, or a third party sales agent. If the end-customer price is less than the standard or into-stock price for the distributor, a payment from the manufacturer will fund the difference between stock price and supported end-customer price.

- The delivery to the end customer is coordinated through the distributor, and often is fulfilled out of in-stock inventory at the distributor.

- The distributor prepares proof-of-delivery / sales data in a claim submitted to the manufacturer to detail the agreed upon price and quantities. A claim for the difference between stock price and supported price is tracked as due to the distributor.

- The manufacturer receives the claim & sales data, validates the detail, and pays the distributor the difference between stock price and supported end customer price.

SPA Process Challenges

SPA processes can be challenging for both the manufacturer and the distributor. Most often, difficulties arise when tracking information related to the negotiated customer price, the product sale and delivery, the financial accruals (accounting for credit due), and payment. Discrepancies can impact either the manufacturer, the distributor, or both.

- Tracking, approving, and selling at the agreed upon end-customer price (all parties)

- Tracking distributor stock price detail (all parties)

- Preparing a claim for SPA credit (distributor)

- Receipt and validation of claims for SPA credit (manufacturer)

- Financial tracking of payment for SPA credit (all parties)

SPA Technology

Managing SPAs with spreadsheets and email chains creates operational chaos and compliance headaches. Modern pricing and rebate management solutions eliminates these pain points by automating the entire SPA lifecycle.

Automated SPA Tracking

Advanced pricing platforms automatically monitor SPA terms across every stage of the sales process. The system validates pricing against active agreements, tracks claims from submission to payment, and maintains complete visibility throughout. Automated tracking minimizes manual reconciliation and disputes that often arise from incomplete documentation.

Seamless System Integration

Integration with CPQ and ERP systems provides real-time validation during the quoting process. Sales teams can instantly verify customer eligibility for special pricing without leaving their current workflow. This connectivity ensures accurate pricing flows from quote generation through invoicing and rebate processing without manual intervention.

Enhanced Accuracy and Compliance

Technology-driven SPA management dramatically reduces human error while strengthening audit readiness. Automated workflows capture all required documentation and maintain detailed audit trails for every transaction. The system proactively identifies potential compliance issues before they escalate into costly disputes or regulatory problems.

These capabilities become especially powerful when integrated with Intelligent CPQ solutions. Vendavo’s pricing and rebate management platform demonstrates how the right technology transforms SPA operations from a manual burden into a strategic business advantage.

Revenue Accounting Processes for Commercial Events

In the world of commercial events, proper revenue accounting is critical to ensuring accurate financial reporting and maximizing profitability. Here is the typical flow per commercial event:

Commercial Event: Pricing for Distributors, Delivery of Products & Invoicing

The revenue accounting process for commercial events involving pricing for distributors, delivery of products, and invoicing is complex and requires careful consideration of several factors. One key factor is end customer pricing negotiation, which can influence pricing for distributors and distributor holding costs. In this scenario, manufacturers typically invoice distributors for stock products, but the revenue recognition options can vary. One option is to allocate a portion of revenue as deferred COGS to reduce revenue for estimated S&D credits, factoring in any special pricing provided to distributors. Another option is to defer the entire revenue until proof of sales is received from the distributor. Both options have their advantages and drawbacks, and companies must carefully consider their revenue accounting approach to ensure accurate financial reporting and maximize profitability.

Commercial Event: Special Pricing Authorization

For commercial events that involve special pricing authorization, revenue accounting involves the supplier reviewing and approving the price impact and adjusting their accounting processes accordingly for accurate financial reporting.

Commercial Event: Distributor Fulfills End Customer Sales Using Negotiated Pricing

When a distributor fulfills end customer sales using negotiated pricing, revenue accounting can be driven by either the approved price at which the distributor sells to the end customer or the expected rebate, which is the difference between the distributor’s buy and contract price. Accruing for expected rebate is a common revenue recognition option in this scenario. By accounting for these pricing factors, companies can ensure accurate financial reporting and maximize their profitability.

Commercial Event: Distributor Submits Tracing and Ship and Debit Claim

When a commercial event involves a distributor submitting tracing and ship and debit (S&D) claims, revenue accounting requires the seller to validate the tracing data and S&D claim before actualizing the posting to COGS or deferred revenue. If the entire revenue has been deferred, revenue can be recognized for the units sold by the distributor. In this scenario, actualizing the posting to COGS from deferral is a crucial step in ensuring accurate financial reporting and maximizing profitability. By carefully managing the revenue accounting process for distributor tracing and S&D claims, companies can make informed financial decisions and optimize their revenue streams.

Commercial Event: Issue Credit for Price Difference

When a commercial event involves issuing credit for a price difference, revenue accounting requires the issuance of credit to the distributor for the approved claim amounts and the reduction of their receivables. This process is critical to ensuring accurate financial reporting and maintaining good relationships with distributors. By properly managing the revenue accounting process for credit issuance events, companies can optimize their revenue streams and minimize the risk of financial discrepancies.

Streamline your SPA Pricing Processes

Vendavo has supported SPA pricing processes for manufacturers and distributors for over 20 years. Based on this experience, we’ve identified proven best practices for automating SPA operations from negotiation through final payment.

Best Practices for Manufacturers

For manufacturers, the common denominator for success hinges on maintaining pricing control and empowering channel partners to compete effectively. Success requires balancing automation with oversight to ensure SPA programs drive profitable growth across the entire distribution network.

Centralized SPA Management

- Implement a unified digital platform that centralizes all pricing agreements with unique identifiers. This eliminates the risk of conflicting pricing terms across different agreements and ensures consistent application of approved discounts throughout the sales process.

- Embed approval workflows and pricing policies directly into the system. Automated workflows enforce compliance with corporate pricing guidelines while reducing the time required for price approvals from days to hours.

- Provide real-time visibility into distributor stock pricing and rebate calculations. Better transparency helps distributors make informed pricing decisions and reduces disputes over rebate amounts during the claims process.

Distributor Partner Support

- Offer self-service price request portals for distributor-led sales opportunities. These portals reduce back-and-forth communication while giving distributors immediate access to pricing options and approval status updates.

- Enable partners to select products and calculate rebate credits automatically. This functionality eliminates manual calculations and ensures distributors understand the true economics of each deal before committing to customers.

- Streamline the evaluation process with contextual metrics and target price guidance. Built-in analytics help manufacturers make consistent pricing decisions while providing distributors with competitive intelligence for their markets.

Claims Processing & Validation

- Establish consistent data templates for rebate claim submissions. Standardized formats reduce processing time and minimize claim rejections due to incomplete or incorrectly formatted documentation.

- Automate claim validation to verify SPA deal IDs, customer eligibility, and rebate amounts. Automated validation catches errors before payment processing.

- Integrate accrual retirement with payment processing to maintain accurate financial records. This automation ensures proper accounting treatment and eliminates manual reconciliation between sales and finance teams.

Rebate management programs can be a substantial competitive differentiator and play an important role in your overall pricing strategy. Typically, employing rebate programs can drive 2-10% incremental sales vs not having a rebate system in place.

Best Practices for Distributors

It’s important for distributors to optimize their SPA operations to maximize rebate recovery and maintain competitive pricing. Progress relies on establishing systematic processes that capture every eligible transaction and streamline claim submissions.

Transaction Management

- Tag all SPA transactions with reference IDs to support rebate claim preparation. Proper tagging ensures no eligible sales are missed during claim preparation and provides clear linkage between original approvals and actual transactions.

- Automate revenue accruals to account for expected rebates and their impact on net pricing. Accurate accruals provide realistic profitability reporting and help sales teams understand the true margin on SPA deals while managing cash flow associated with expected net price realization.

- Maintain clear tracking of approved SPA pricing and delivery confirmations. This documentation becomes critical during manufacturer audits and helps resolve any disputes over pricing or delivery terms.

Rebate Claim Operations

- Quickly package proof-of-sale documentation through integrated processing systems that automatically compile transaction details for rebate credit submissions. This approach transforms claim preparation from a time-consuming manual task into an efficient automated workflow.

- Adhere strictly to manufacturer-defined data formats and submission standards to expedite rebate receipt. When manufacturers provide recommended templates or formats, these specifications can dramatically accelerate your earned rebate processing and reduce rejection rates.

- Establish a central tracking system for all submitted claims to monitor status throughout the validation and payment process. When manufacturers permit it, leverage invoice payment deductions strategically to manage cash flow while awaiting rebate processing.

- Develop comprehensive reporting capabilities that track SPA deal volume, pricing decisions, and claim status across all manufacturer partnerships. These insights reveal performance patterns and identify the most valuable program relationships in your portfolio.

Performance Monitoring

- Analyze program ROI using comprehensive analytics and performance dashboards. This ongoing evaluation reveals which programs generate the highest returns and guides future program investments.

- Establish rebate recovery benchmarks and continuously assess claim success rates. When you better understand patterns in claim delays or failures, you can refine internal processes and build stronger partnerships with manufacturers.

- Create comprehensive audit trails for every SPA transaction and associated claim. Well-organized documentation serves as your defense against compliance challenges and positions you favorably during manufacturer reviews or internal financial audits.

Strong distributor practices ensure maximum rebate capture while minimizing the risk of claim rejections or delays. These operational disciplines directly impact profitability and cash flow management across the business.

To proactively design and manage your rebate programs across channels, check out Vendavo Rebate & Channel Manager

Stay Competitive with Vendavo

To manage end-customer pricing and maintain competitiveness in active markets, SPA pricing programs can be very valuable tools for manufacturers who sell through distribution. Despite the value of these programs, they can be laborious programs to manage from an execution and accounting standpoint.

Vendavo offers end-to-end process support solutions that include all aspects of the best practices discussed in this overview. Learn more about Rebate & Channel Manager.