Margin Bridge Analyzer

Comprehensive price-volume-mix analysis across all your business dimensions

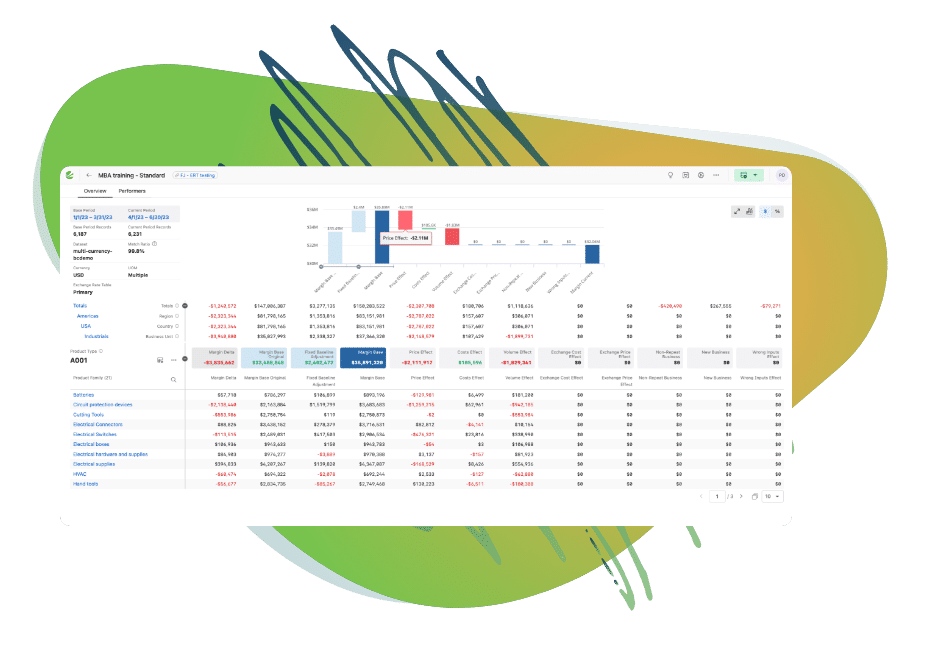

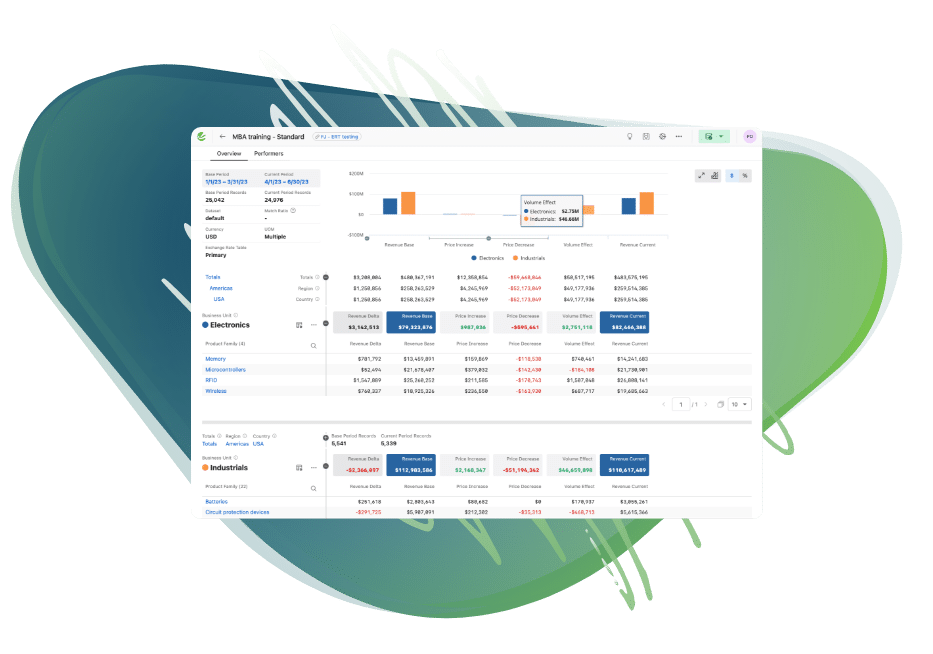

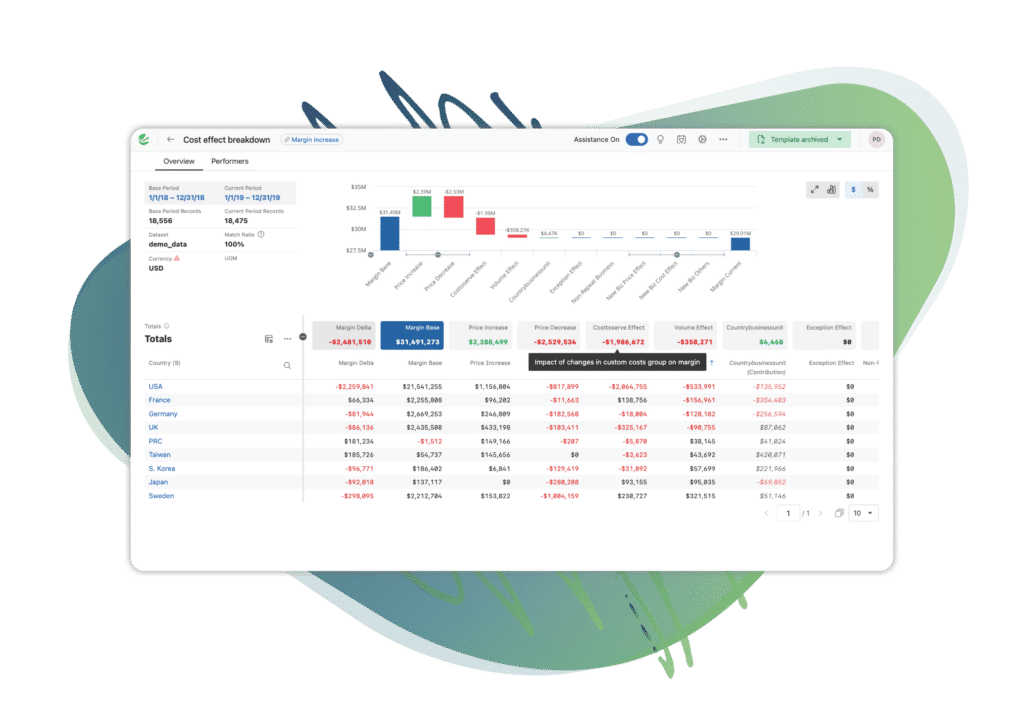

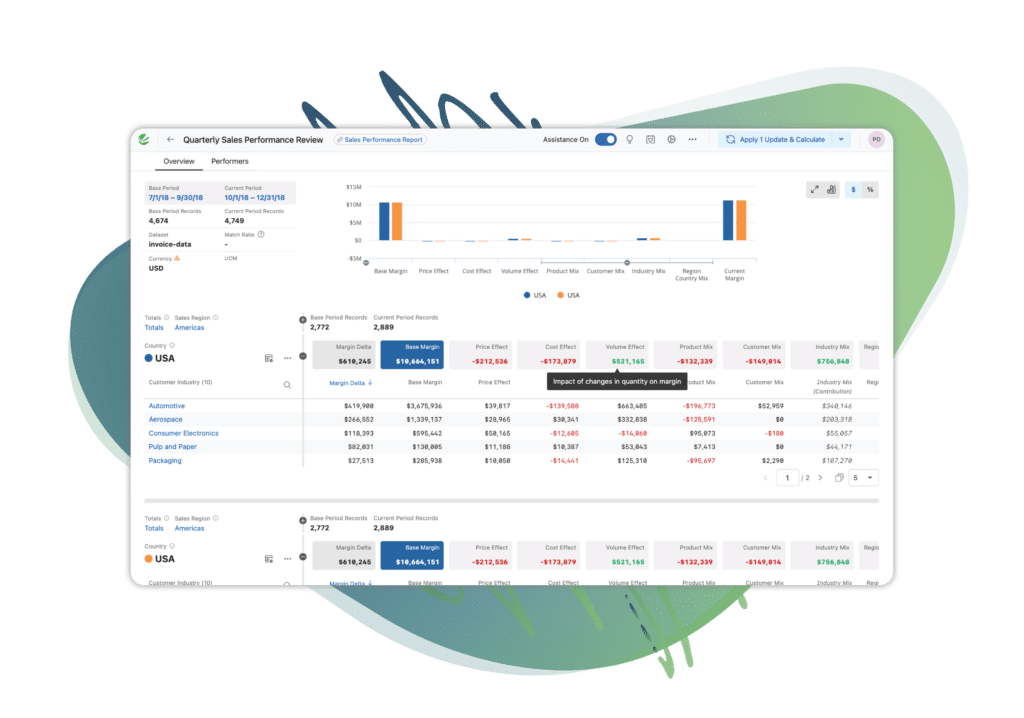

Easily Build Custom Revenue and Margin Bridges

Build and maintain unlimited, user-defined price-volume-mix analysis through intuitive, clicks-not-code configuration with Vendavo Margin Bridge Analyzer. Generate your own price-volume-mix models that meet your organization’s unique needs for aggregating data, defining mix, and drilling down through your margin analysis.

- Provide finance, accounting, and management teams impactful, easy-to-consume insights

- Quickly analyze, simulate, and explain revenue and margin changes

- Measure the impact of your pricing strategy and tactics

3%

Prevented Rebate Overpayment

1.8%

Increased Channel Satisfaction

1.2%

Avoided Rebate Penalties

Take a Self-Guided Tour of Margin Bridge Analyzer

Fluidra Protects Margin and Drives Profitability with Vendavo Margin Bridge Analyzer

Discover how Fluidra leverages Vendavo to protect margins, maintain profitability, optimize commercial processes, and gain greater visibility and transparency into pricing data, enabling well-informed business decisions in a complex global environment.

Help Your Teams and Organization with Margin Bridge Analyzer

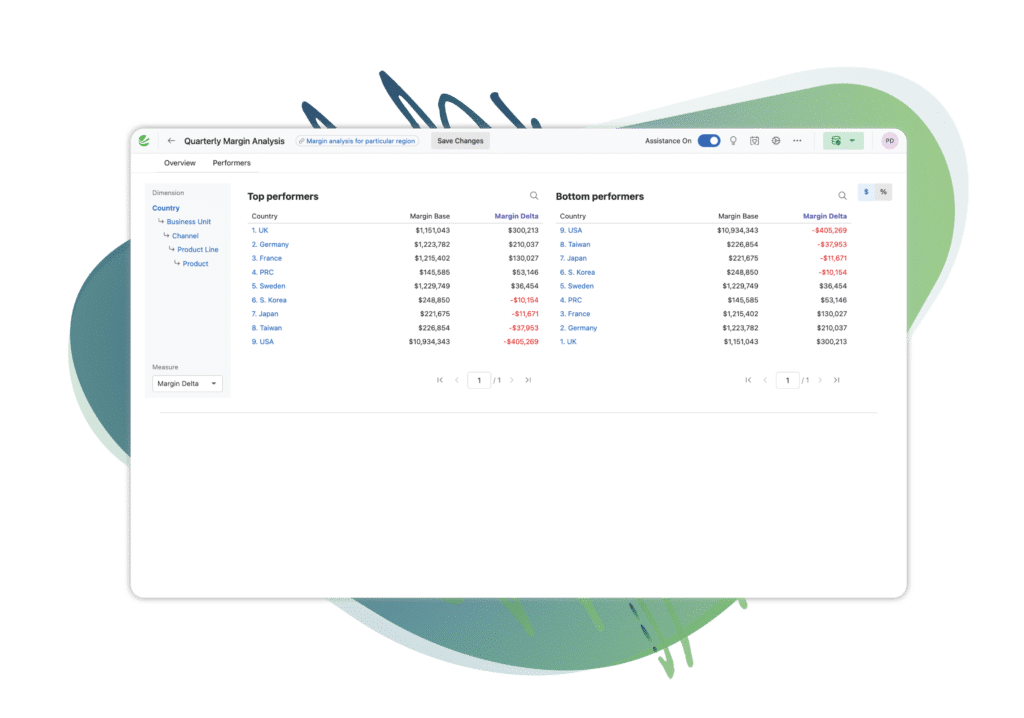

Margin Bridge Analyzer’s custom models let Finance and Pricing leaders easily explain how your top and bottom-line growth is affected by various dynamic effects to different stakeholders in your organization.

For businesses with a large product portfolio, multiple business units or sales channels, or serving many regions globally, Margin Bridge Analyzer helps leaders across departments, from Finance to Pricing to Product, quickly answer critical commercial questions like:

- What are my most profitable products?

- Which channels are over or underperforming?

- Is volume affecting my profitability?

- How much are discounts affecting my business’ margin?

Read More: Using a Price-Volume-Mix Analysis to Improve Performance

For many businesses, performing price volume mix (or margin bridge) analysis is a time-consuming, manual effort, prone to errors. With Margin Bridge Analyzer, Finance and Pricing departments can save valuable resources with automated, customizable reports configured to surface relevant analysis for each stakeholder.

Between evolving supply chains, volatile raw material costs, and increasing competition, it’s hard for pricing managers to implement pricing strategies that ensure profitability. Margin Bridge Analyzer takes the manual effort and guesswork out of the decision-making.

Identify outperformers and underperformers among comparable customers and markets across sales channels or geographic regions using peer benchmarking. Engage with key stakeholders (Sales Managers, Sales Reps, Pricing Managers) to agree on action plan and increase margins.

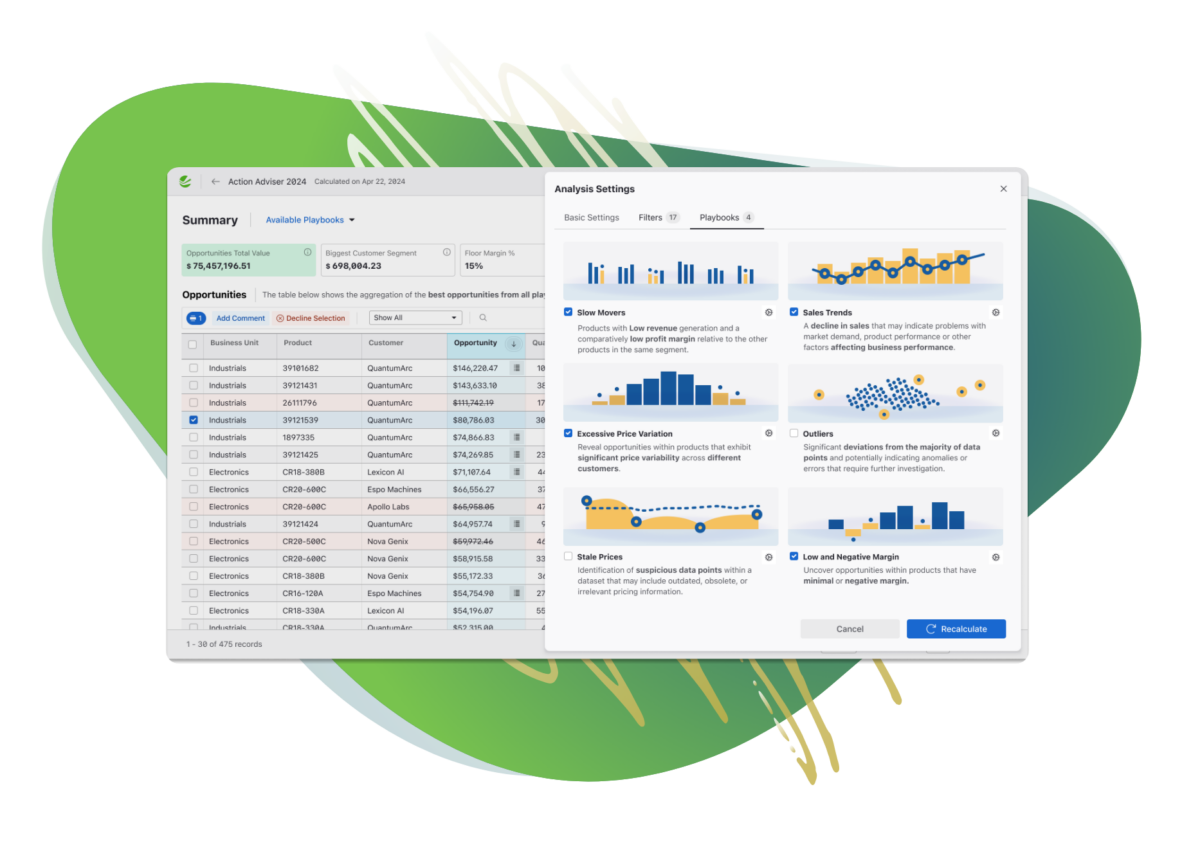

With Playbooks, pricing leaders can easily identify opportunities for margin leakage and then take corrective actions. Improve pricing execution and reduce the time spent on analysis to create a repeatable, predictable, and auditable process

Simplify commercial processes and provide sellers and teams with confidence, context, and insights for deals, opportunities, and pricing. Alert Sales of potentially risky customer buying changes. Share opportunities and ways for sales teams to sell more with better guidance.

A Selection of Our Integration Partners

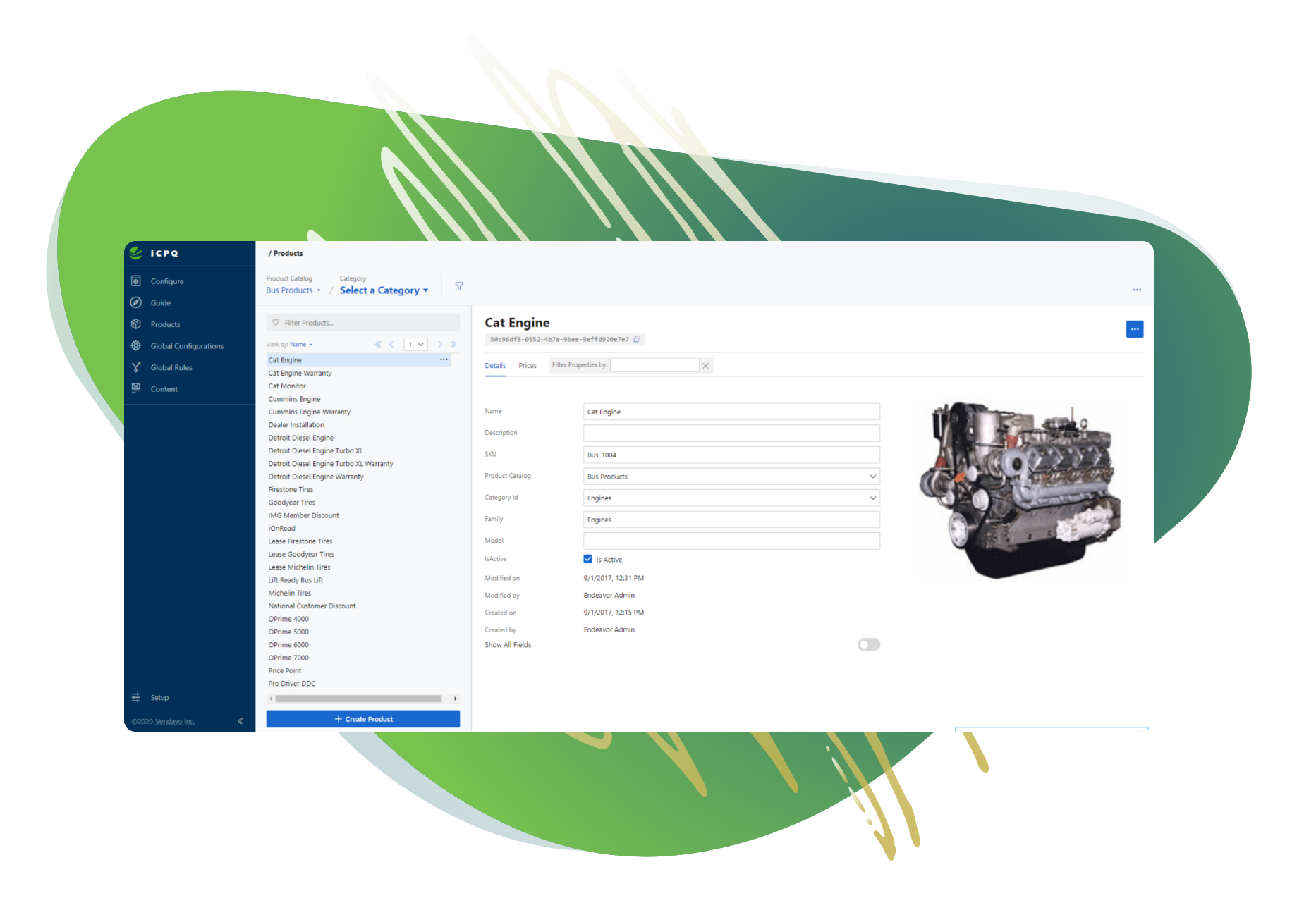

Extend the Benefits of Margin Bridge Analyzer Across Your Business Processes

Whether you need to connect to any ERP, CPQ, or CRM system, you can do so through the many available APIs and connectors.