This article first appeared on CFO Innovation. See the original post here.

Price optimization is a capability that is finally making its way into the mainstream for companies in all industries. The term broadly refers to approaches for setting list or target prices that achieve a certain objective or goal, and that are based on some sort of data and mathematical formulas.

Some optimization approaches are intended to optimize yield on perishable products (like a seat on a flight soon to depart). Others are intended to optimize contribution margins. Still others are designed to balance both upside profit potential with the downside risk of losing business.

Whatever the goal, the CFO and the finance team are (or should be) part of the price optimization process.

One product can be sold at different price points into several different markets or end-use applications because customers perceive value differently and therefore have a different willingness-to-pay.

Previously, price optimization was practiced only in certain verticals with massive amounts of transactional data like airlines and hospitality or retail and fast-moving consumer goods. It is now becoming the new norm for progressive companies in B2B industries like process manufacturing, industrial and high-tech manufacturing, wholesale distribution, professional and business services, transportation and logistics.

Traditionally, the impetus for taking advantage of price segmentation and optimization approaches has been a financial one. We will explore this first, and then note three key implications for customer experience as well.

The Financial Case

Most of these progressive companies have begun to leverage more advanced pricing capabilities for their ability to drive profit gains (10%-30% gains in operating profit) and subsequent returns on investment (projects with measurable ROIs of 500%-800%).

The reason for the strong benefits results is simple: a very small improvement in realized price translates into a very large increase in operating income. Because the gains in realized price carry no incremental costs like COGS or additional overhead, all the gains in revenue go straight to operating income.

When considering a typical Global 1200 company, various management consulting firms have noted for years that a 1% improvement in realized price typically translates into a 10%-12% gain in operating profit. This impact is significantly greater than any other profit lever such as variable costs, fixed costs, or sales volumes.

Deloitte has published a study in the Journal of Professional Pricing that noted an average benefit of 3.2% in realized price across over 100 pricing projects spanning five years. That translates into an average 32% increase in operating profit.

As one price-optimization software client, a Fortune 50 company, noted at their user conference: “How can you afford not to invest in this capability?”

Customer Segmentation Is Key

Where does the increase in realized price come from? Is it as simple as just raising prices?

The basis, especially in B2B industries, comes from being able to discern, measure, and then leverage how different customers value your products differently.

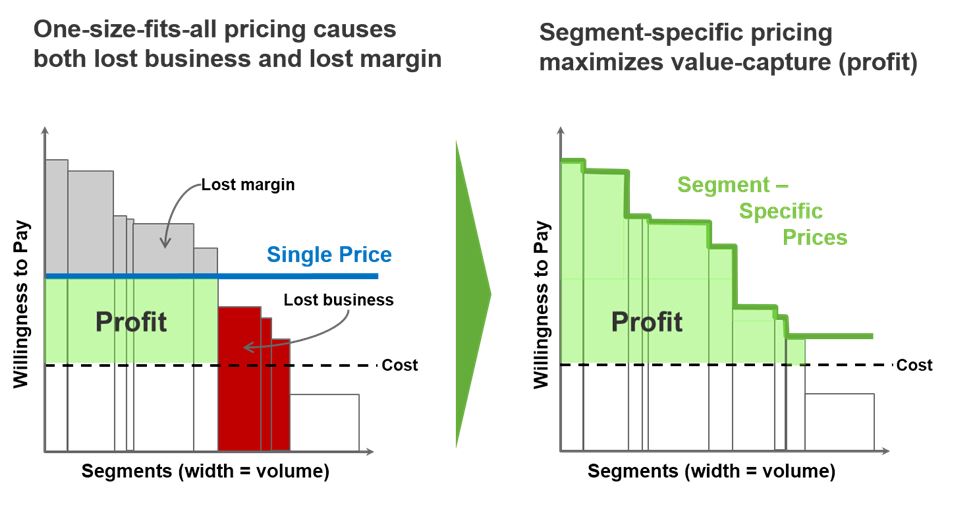

For example, one product can be sold into several different markets or end-use applications. The customers in those different markets or applications perceive value differently, and therefore have a different willingness-to-pay. These clusters of customers and products are essentially pricing segments that can be treated differently to maximize value-capture for the organization.

If your sales and marketing department has a single list price or target selling price for that product, you are limiting the potential revenue (and margin) you could be capturing (see illustration below).

One of the keys to this approach is developing a good understanding of these segments and how they behave with respect to pricing.

As computing power continues to get faster and cheaper, modern software tools have now made this kind of analysis and segmentation possible whether there are terabytes of data to utilize – or very sparse data.

Pricing optimization has traditionally been utilized for financial reasons, but some companies are also seeing significant improvements in customer experience.

Improved Customer Experience

While the financial rationale is usually the primary reason companies invest in capabilities around pricing segmentation and optimization, what is often overlooked is that these capabilities properly applied can also improve your customer experience.

There are at least three ways pricing optimization can do this.

Accurate pricing from the start. As we’ve noted above, different customers have different value perceptions and therefore levels of willingness-to-pay. By fine-tuning your offer (including pricing, of course) to each segment, you’re tuning in to a more suitable and appropriate offer for each customer interaction.

When a sales person offers a price that is based not on some broad-brush approach to the market or gut feel, but based rather on similar customer/product/channel situations, the price will be more accurate from the beginning. This reduces the friction in the sales or negotiation process as you’re starting out at a more accurate price to begin with.

More efficient quoting process. By leveraging modern tools and processes for price optimization, the quoting process for customers becomes more efficient. The optimal price is determined in nearly real-time, and can be returned to the sales person and customer just as fast.

This price, being already supported by data and sound strategy, doesn’t then need a long string of approvals, speeding up the quoting process.

A large high-tech OEM organization implemented new capabilities in this area and saw dramatic improvements in the speed with which they could return price quotes to their customers. This improvement in the customer experience translated into a dramatic increase in this company’s win-rate for their quotes.

The customers were voting with their pocketbooks that they approved of the optimized pricing (and more efficient process) as well.

Data-driven prices. When approaches like pricing segmentation and optimization are utilized, the sales team or price negotiators have a reliable – and logical – set of supporting data to help them sell more confidently.

If a customer questions the validity of a price (even if for purely negotiating purposes), the sales person has a set of rational peer-deal examples available to support his offer. This adds some logic and reason to the pricing discussion vs. old-school haggling and brinksmanship.

The Takeaway

The case for pricing optimization is clear and strong. But while it has traditionally been utilized for financial reasons (increases in revenue and profitability), some companies are also finding that when they invest in up-leveling their pricing capabilities, they are seeing significant improvements in customer experience as well.