Originally published on September 26, 2024. Last updated on February 20, 2025

Vendavo’s 2025 Pricing and Profitable Growth Outlook surveyed the industry’s top pricing professionals for their views on pricing talent, maturity, challenges, pricing models, and more. Morgan Short, Senior Director of Content & Web Strategy covers some of the highlights from the research and unpacks how organizations can build their pricing strategy, bridge the C-suite gap, quantify pricing impact, and embrace AI’s influence.

Pricing is more than just applying a standard mark-up to costs—it’s about delivering the right price, to the right customer, at the right time. With increasing competitive and economic pressures, organizations must balance customer expectations, willingness to pay, and profitability while navigating increasingly complex challenges.

Price optimization is the process of deciding the most effective pricing for a product or service. It is how organizations find the optimal price their customer is willing to pay for a product: not so high that they risk losing that customer’s business, not so low that they sacrifice margin. While counter-intuitive, price improvement has a greater positive impact on the bottom line than cost-cutting.

When it comes to optimizing your pricing for superior customer experiences and profitability, here are 10 key trends to take note of today.

10 Key Pricing Trends to Leverage This Year

1. Emerging Priority: Customer Experience Drives Willingness to Pay

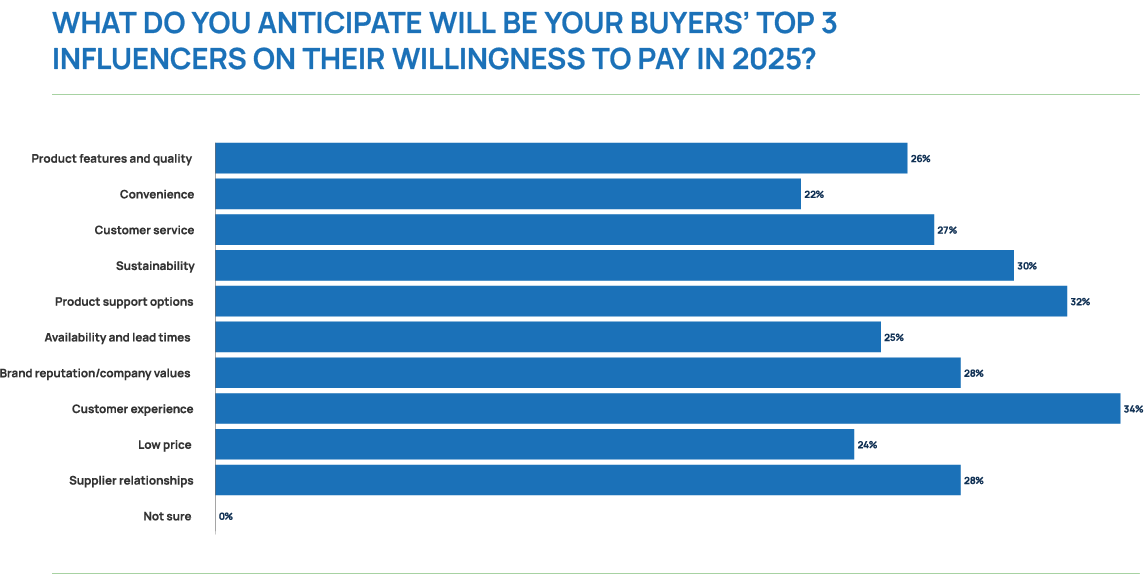

Based on Vendavo’s 2025 Pricing for Profitable Growth Outlook: Customer experience (34%) and product support (32%) will surpass sustainability (30%) as the top factors influencing buyers’ willingness to pay thresholds. As such, brand reputation/company values rank higher for distributors (33%) compared to manufacturers.

Buyers increasingly prioritize frictionless transactions and post-purchase support over sustainability commitments as economic optimism grows. But, “it’s not about sacrificing one for the other—it’s about integrating sustainability into a broader value proposition,” highlights Kalle Aerikkala, Business Consultant at Vendavo.

“When you combine sustainable efforts with solid product support and reliable availability, you can justify higher prices while meeting both customer expectations and regulatory demands. The key is to use pricing strategies that reflect the full value you’re offering, not just the cost,” he adds.

2. Pricing Function Demands Strategic Investment

Getting the right people on board is mission-critical for a well-executed pricing strategy, and talent acquisition is projected to be a top priority.

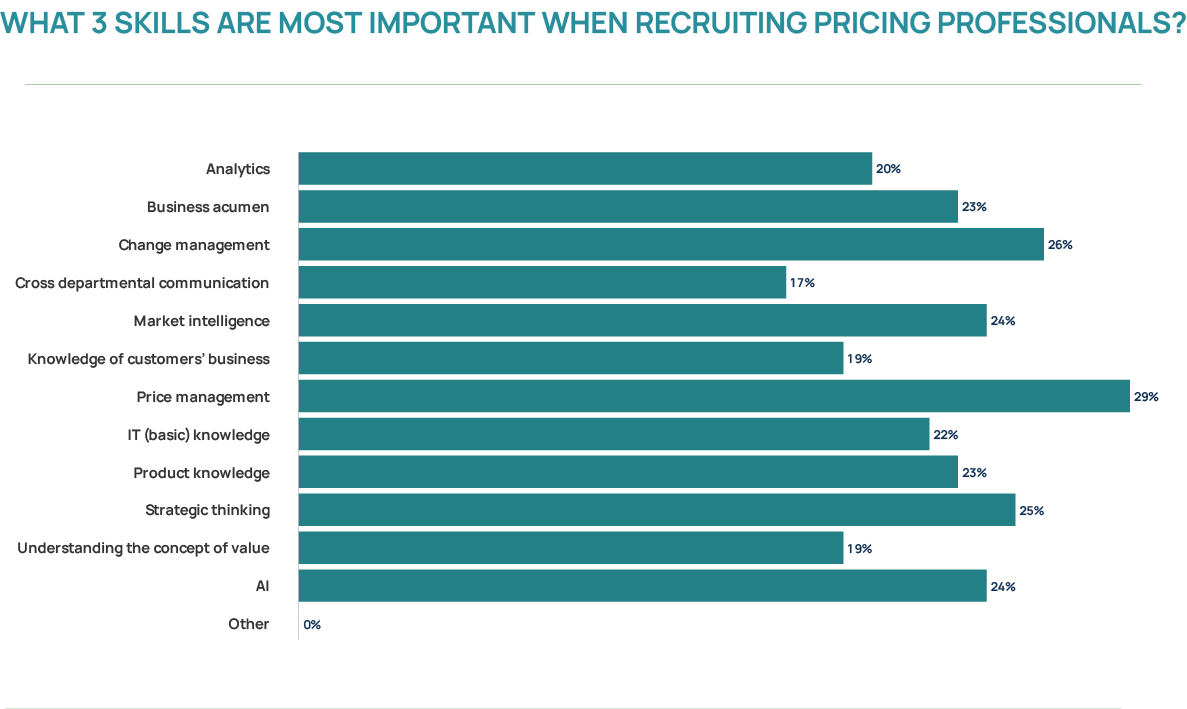

Vendavo’s report found that 52% of enterprises employ 11-20 pricing specialists, with 95% planning to acquire more price-centric talent. The top three most critical skills include price management (29%), strategic thinking (25%), and AI proficiency (24%).

The ROI speaks for itself: a 1% price improvement drives 8.7% operating profit growth, according to McKinsey & Company, justifying investments in skilled employees and AI-powered pricing platforms.

3. AI Will Drive Price Management Practices

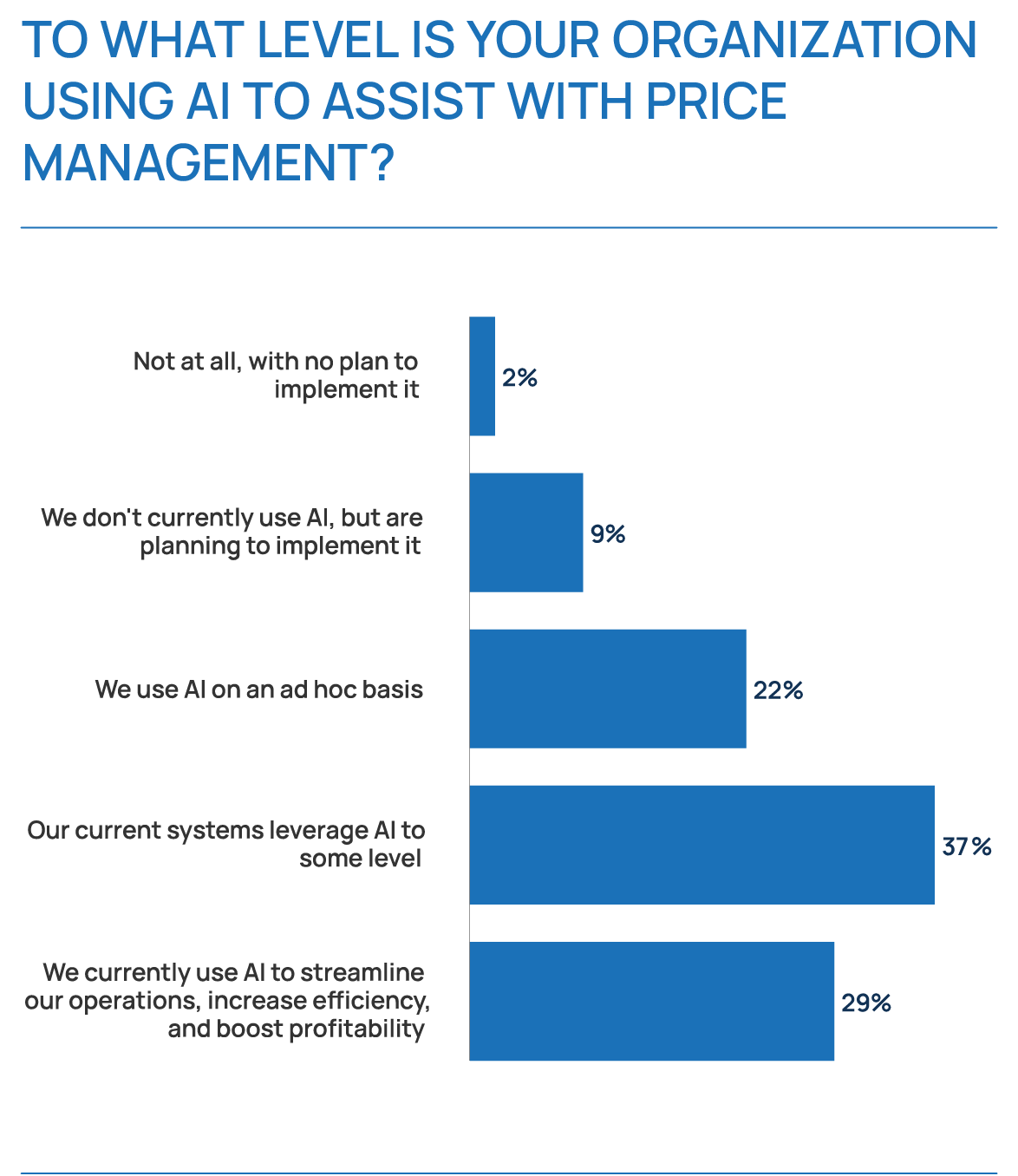

A little over one-third (37%) of manufacturers and distributors say their current systems leverage AI to some level to assist with price management, according to Vendavo’s report. Almost half (45%) say AI will improve and scale pricing processes, but they are slowly moving forward with fully adopting AI technologies.

Ajay Raiyani, Solutions Director at Experis Pricing Solutions, foresees, “As AI recommendations align more with market expectations, trust in the tool grows. A human-AI partnership is key to successful AI adoption in pricing. This enables more accurate pricing decisions, leading to higher margins and a better competitive edge for clients.”

4. Take Control of Your Pricing Strategy, Now

We caught up with some of the brightest minds in pricing at Vendavo’s 2025 Sales Kickoff in Atlanta and asked them “what’s in” and “what’s out” for 2025. Check out this video of the event on LinkedIn.

- What’s out? Blackbox AI, inability to make decisions, legacy pricing processes, inflexible structures, wait-and-see approaches.

- What’s out? Taking control of your growth and profitability, having a plan for tariffs, agility, new pricing processes, and AI that’s focused on business outcomes.

“You have to leave behind being passive, just sitting and waiting,” said Dan Cakora, Business Consultant at Vendavo. “Let’s go. You gotta get on the bus at some point and take control of your pricing destiny. Tariffs…they’re kind of floating out there in the ether. But what’s gonna happen with them? You don’t know when. You don’t know how deep. But they’re coming. Or maybe they’re not… So, that means you have to be agile and respond to the situation.”

5. Pricing Agility is the Name of the Game

Economic pressures like inflation and tariffs are putting increased pressure on strategic pricing initiatives. In the face of political uncertainty, pricing for tariffs introduces greater complexity and potential for margin erosion. In turn, the majority (90%) of manufacturers and distributors are concerned about how quickly they can respond, putting organizational agility in question.

Before adjusting their prices to inflation, manufacturing leaders prioritize revenue gain goals (45%). Distribution leaders are most concerned with maintaining margin (38%) and meeting customer demand (37%). Both manufacturers and distributors report their top price optimization strategy is the value-based approach (28%), followed by the market-based approach (25%).

To combat the reality of mounting tariffs in the U.S., leverage our playbook for pricing, profitability, and market resilience amidst these economic pressures.

6. Bridge the Gap with the C-Suite

A good relationship between pricing and the C-suite is crucial for driving pricing initiatives, gaining executive buy-in for pricing decisions, and aligning pricing strategies with broader business objectives. While most report they have this strong tie in place, a concerning 24% say the relationship is poor.

This is a problem because when the C-suite understands and supports the pricing function, it becomes easier to secure necessary resources, implement pricing changes, and drive pricing as a strategic lever for business success.

“First, organizational alignment and clear responsibilities are key. Stakeholders must agree on the benefits, with C-suite backing to ensure alignment,” said Jacob Møller Korsgaard, Pricing Director at Danfoss. “Thorough system mapping is essential for effective integration, as it enhances operational excellence, price quality, and customer satisfaction.”

7. Dynamic Pricing Adoption Trends Upward in 2025

The shift away from uniform pricing strategies is accelerating, with 2025 pricing trends showing manufacturers adopting dynamic pricing models that analyze real-time supply chain conditions, energy costs, and customer behavior (e.g., AI-driven adjustments for raw material volatility).

Legacy one-size-fits-all strategies are increasingly unviable. Vendavo’s previous year’s report found that 46% of businesses report margin erosion from undifferentiated pricing. In turn, there’s been increased adoption of hybrid models combining dynamic, cost-plus, and value-based elements.

The key is to evaluate the effectiveness of your current pricing approach and consider different pricing methodologies as needed. Oftentimes, combining multiple strategies are usually needed to govern tactics spread across multiple product lines, sales regions, or even customer types. This is how you meet your customers’ expectations without leaving money on the table. To understand different pricing models, read: Mastering B2B Pricing Strategies: Comprehensive Guide with Examples.

8. Compensation Models Are Evolving to Retain Pricing Talent

Talent retention and compelling compensation packages are areas of focus, particularly in manufacturing where employee satisfaction matters. Based on findings from EPP and Vendavo’s Pricing and RGM Salary Outlook 2025, 4 in 5 professionals are satisfied with the nature of their work and 70% of pricing executives in their role for over five years are being retained

Manufacturers and distributors must balance short-term incentives (bonuses tied to margin targets) with long-term retention tools like pension plans and hybrid work flexibility. Companies should adopt tiered bonus structures that reward both individual performance (e.g., deal profitability) and team-based metrics like price realization rates.

9. Pricing Analytics Remains a Competitive Advantage

One way to gain a competitive edge is to prioritize key pricing skills for future employees and provide ample training for current employees. In Vendavo’s Pricing Excellence Report and 2024 Outlook, the most valued skill for pricing was overwhelmingly strong pricing analysis (75%).

“Organizations should prioritize these skills by tailoring recruitment to assess analytical capabilities, offer training programs in pricing strategy, and encourage continuous learning in data analytics,” advises Katie Thompson, Managing Director at Experis Pricing Solutions.

The volume of dynamic data to be considered for arriving at the right price for the right customer is significant, including market trends, product preferences, buyer sentiment, transaction history, and more. If you’re able to grow your team, hire someone with strong pricing analysis skills to sort through the data. If not, identify someone on your team who is willing to hone those skills. It will pay off.

Pricing optimization software will help them organize, analyze, and report the data – and, most importantly, provide context for actions that improve win rates and profitability.

10. AI Skills Gaps Threaten Pricing Agility

The RGM Salary Outlook report mentioned above flags a critical vulnerability: pricing teams lack AI-augmented negotiation and predictive analytics skills needed to manage volatile input costs (energy, logistics). Similarly, AI was the top reported challenge organizations expect to face in the next 12 months, according to Vendavo’s 2025 Pricing Outlook.

The former report found that 50% of professionals received no specialized pricing training in 2024, with 36% having no plans for 2025 upskilling. And only 28% of organizations actively develop AI/technical skills despite 47% offering managerial training.

Vendavo’s warning that teams are “insufficiently equipped to weather coming storms” is aligned with Bain & Company’s finding that 74% of executives struggle with AI adoption due to data silos. In short, organizations can benefit from partnering with tech providers for embedded upskilling (e.g., AI-powered CPQ simulations) and mandate quarterly technical certifications for pricing roles.

Final Thoughts on Pricing Trends

Before we close out this article on today’s top pricing trends, here’s a quick refresher on what price optimization is not: lowering prices may win more deals, but that success might not be evident on the bottom line, unfortunately. Margins will suffer, profitability will plummet, and your leadership will want to know what’s going on. Rather than quick, seat-of-the-pants, across-the-board price cuts, identify your customers’ willingness to pay for specific products, and be ready to price accordingly.

Pricing strategies are more critical than ever for driving growth and profitability. Trends like AI-powered dynamic pricing, agile pricing models, and targeted talent development are reshaping how businesses approach pricing.

Vendavo’s solutions empower manufacturers and distributors to stay ahead by streamlining Configure-Price-Quote (CPQ), rebate management, and dynamic pricing processes while equipping teams with the tools and insights needed to succeed. With Vendavo’s expertise and powerful pricing solutions, businesses can deliver the right price at the right time, ensuring sustainable profitability and customer satisfaction.

Request a demo to learn more.